Question: IE Exercise 9 - 7 ( Static ) : Computing payroll taxes LO P 2 , P 3 BMX Company has one employee. FICA Social

IE Exercise Static: Computing payroll taxes LO P P

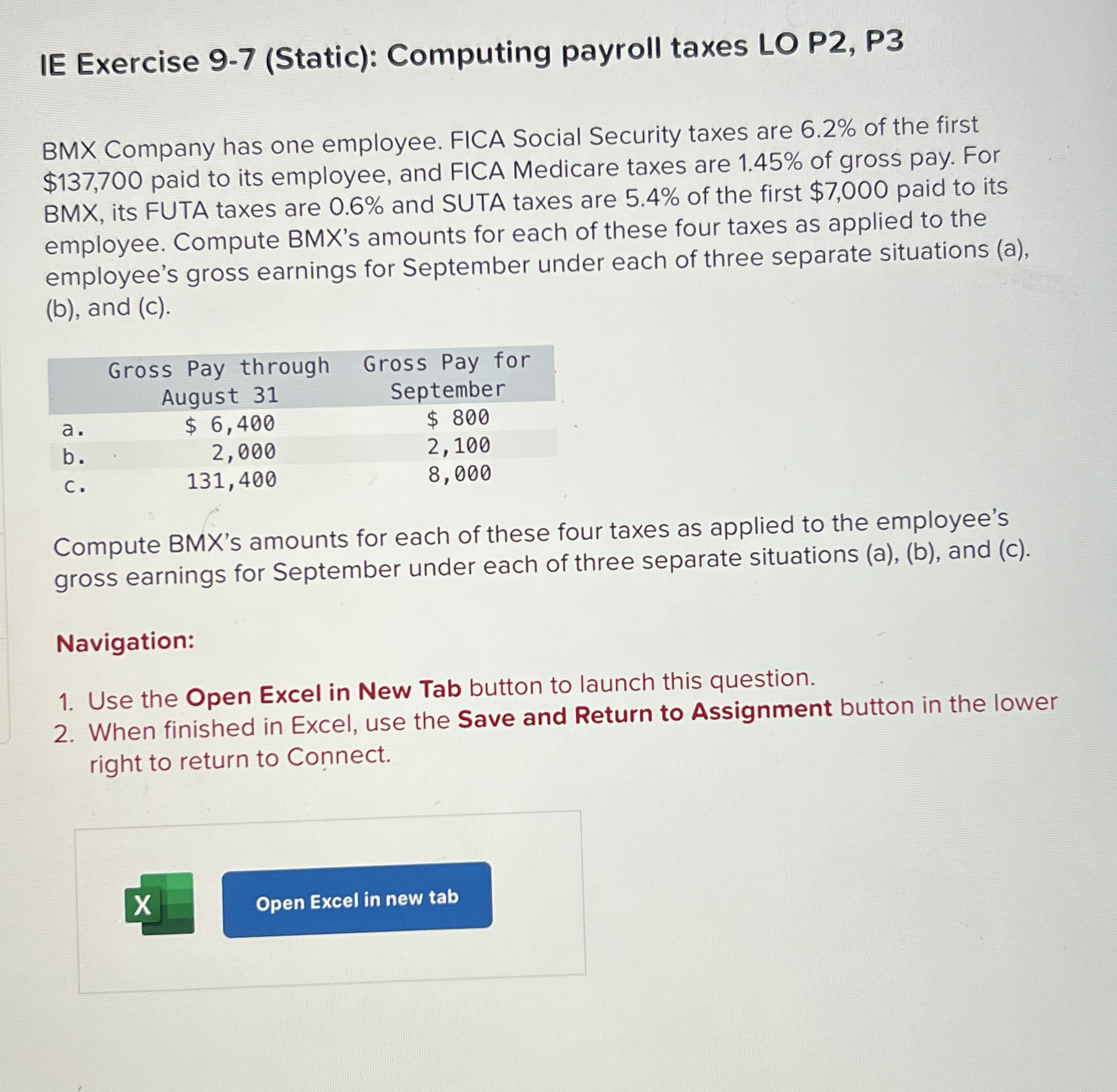

BMX Company has one employee. FICA Social Security taxes are of the first $ paid to its employee, and FICA Medicare taxes are of gross pay. For BMX its FUTA taxes are and SUTA taxes are of the first $ paid to its employee. Compute BMXs amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations ab and c

tableGross Pay throughAugust

tableGross Pay forSeptember

Compute BMXs amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations ab and c

Navigation:

Use the Open Excel in New Tab button to launch this question.

When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock