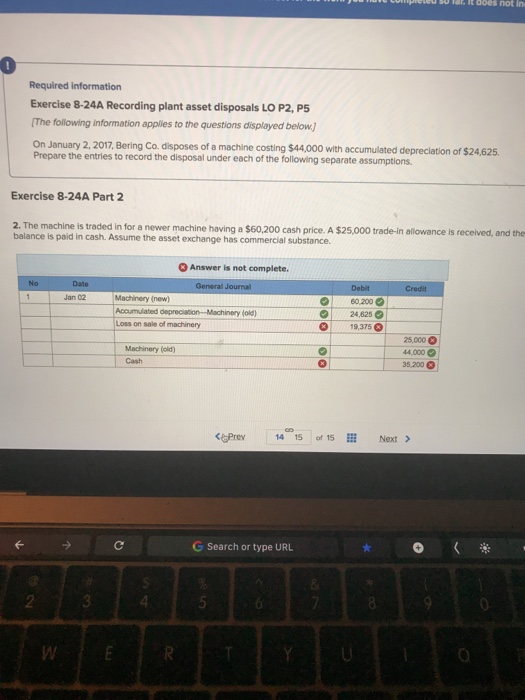

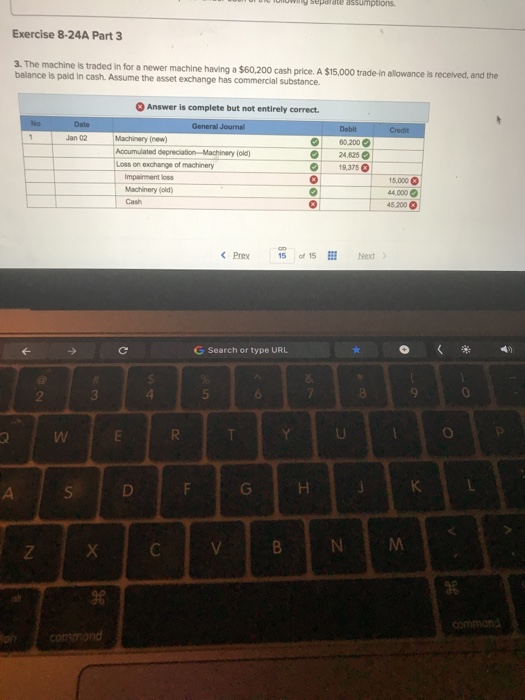

Question: ied so far it does not in 0 Required information Exercise 8-24A Recording plant asset disposals LO P2, P5 The following information applies to the

ied so far it does not in 0 Required information Exercise 8-24A Recording plant asset disposals LO P2, P5 The following information applies to the questions displayed below On January 2,2017, Bering Co. disposes of a machine costing $44,000 with accumulated depreclation of $24,625. Prepare the entries to record the disposal under each of the following separate assumptions. Exercise 8-24A Part 2 ne maine in ae sion e newerchine having a $60,200 cash price A $25,000 tade in alowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Answer is not complete. 1Jan 02 Machinery (new) 60.200 24,625 19,375 (ole) Loss on sale of machinery Machinery (old) Cash 25,000 4,000 35,200 ePrey 14 15 of 15 Next > G Search or type URL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts