Question: If a bank has a negative GAP, we can be sure that: A) The bank's duration GAP will be positive B) The bank's duration GAP

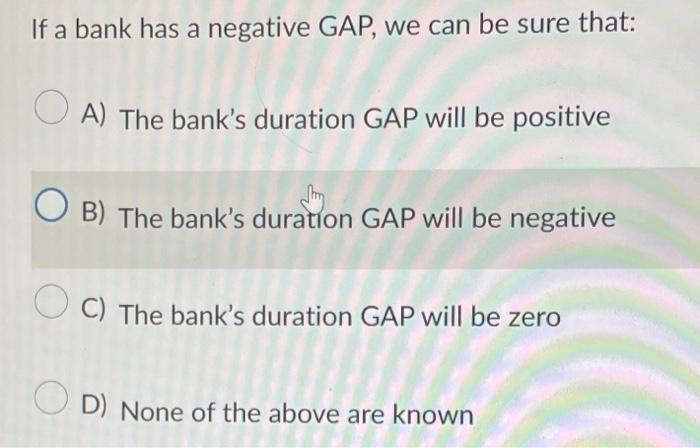

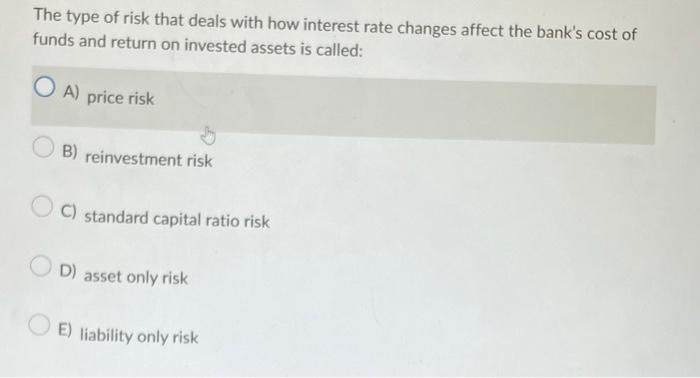

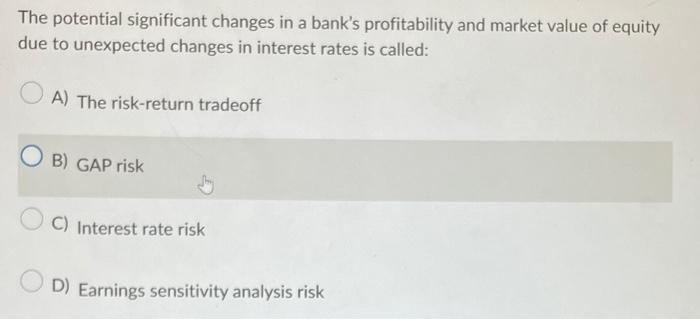

If a bank has a negative GAP, we can be sure that: A) The bank's duration GAP will be positive B) The bank's duration GAP will be negative C) The bank's duration GAP will be zero D) None of the above are known The type of risk that deals with how interest rate changes affect the bank's cost of funds and return on invested assets is called: A) price risk B) reinvestment risk C) standard capital ratio risk D) asset only risk E) liability only risk The potential significant changes in a bank's profitability and market value of equity due to unexpected changes in interest rates is called: A) The risk-return tradeoff B) GAP risk C) Interest rate risk D) Earnings sensitivity analysis risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts