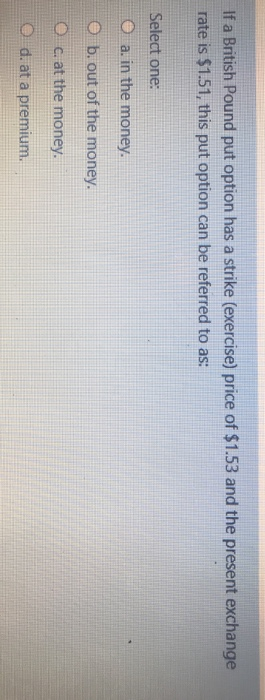

Question: If a British Pound put option has a strike (exercise) price of $1.53 and the present exchange rate is $1.51, this put option can be

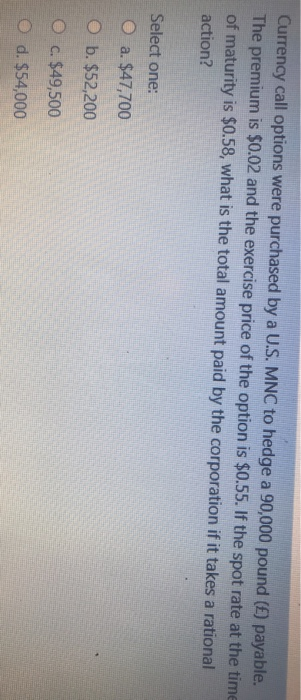

If a British Pound put option has a strike (exercise) price of $1.53 and the present exchange rate is $1.51, this put option can be referred to as: Select one: a. in the money. b. out of the money. c. at the money. O d. at a premium Currency call options were purchased by a U.S. MNC to hedge a 90,000 pound () payable. The premium is $0.02 and the exercise price of the option is $0.55. If the spot rate at the time of maturity is $0.58, what is the total amount paid by the corporation if it takes a rational action? Select one: a. $47,700 O b. $52,200 O c. $49,500 O d. $54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts