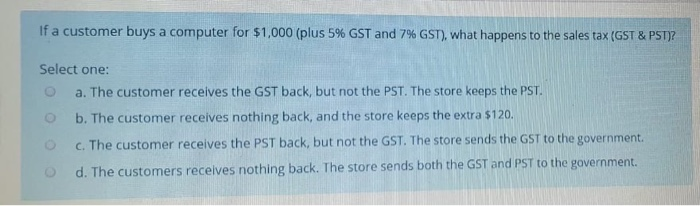

Question: If a customer buys a computer for $1,000 (plus 5% GST and 7% GST), what happens to the sales tax (GST & PST)? Select one:

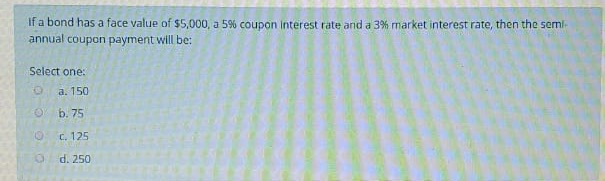

If a customer buys a computer for $1,000 (plus 5% GST and 7% GST), what happens to the sales tax (GST & PST)? Select one: O a. The customer receives the GST back, but not the PST. The store keeps the PST. b. The customer receives nothing back, and the store keeps the extra $120. c. The customer receives the PST back, but not the GST. The store sends the GST to the government. d. The customers receives nothing back. The store sends both the GST and PST to the government. If a bond has a face value of $5,000, a 5% coupon interest rate and a 3% market interest rate, then annual coupon payment will be: Select one: a. 150 b. 75 c. 125 d. 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts