Question: If a firm accepts Project A it will not be feasible to also accept Project B because both projects would require the simultaneous and exel

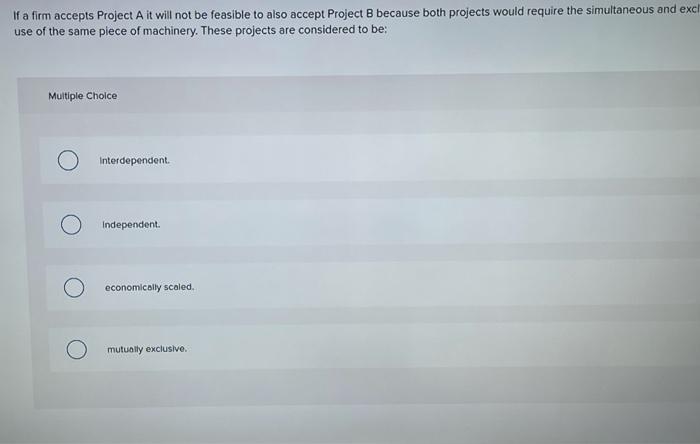

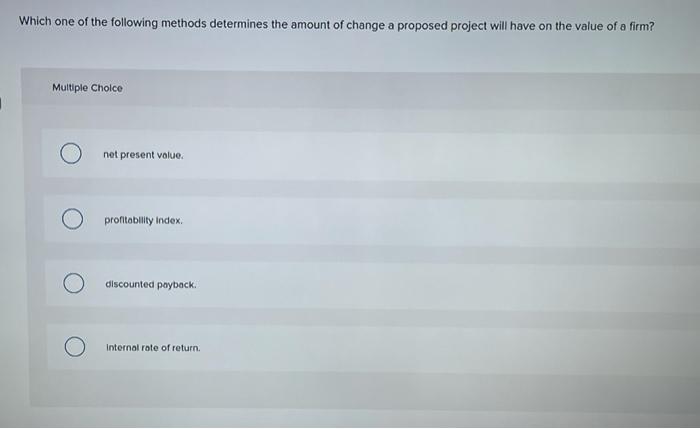

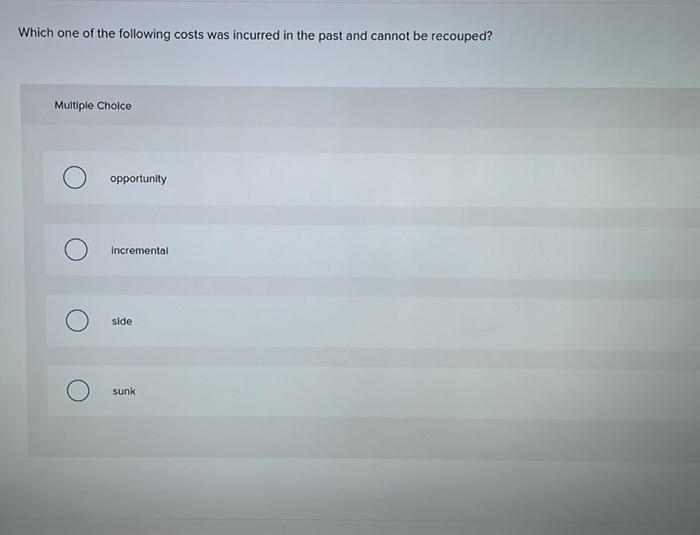

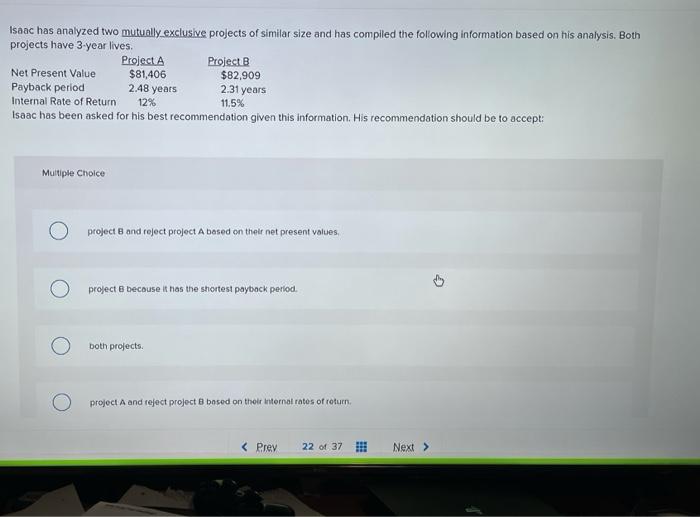

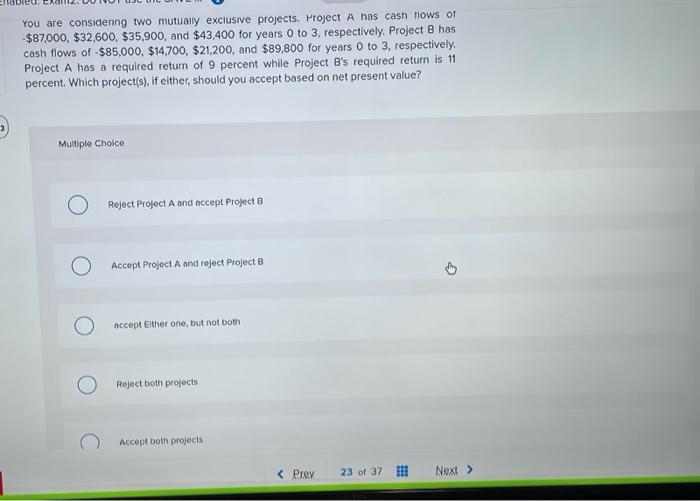

If a firm accepts Project A it will not be feasible to also accept Project B because both projects would require the simultaneous and exel use of the same piece of machinery. These projects are considered to be: Multiple Choice Interdependent Independent economically scaled. mutually exclusive Which one of the following methods determines the amount of change a proposed project will have on the value of a firm? Multiple Choice net present value profitability Index discounted payback. Internal rote of return. Which one of the following costs was incurred in the past and cannot be recouped? Multiple Choice opportunity Incremental side sunk Isaac has analyzed two mutually exclusive projects of similar size and has compiled the following information based on his analysis. Both projects have 3-year lives. Project A Project B Net Present Value $81,406 $82,909 Payback period 2.48 years 2.31 years Internal Rate of Return Isaac has been asked for his best recommendation given this information. His recommendation should be to accept: 12% 11.5% Multiple Choice project and reject project A based on their net present values project because it has the shortest paytrack period. both projects. project A and reject project based on their internal rates of return You are considenng two mutually exclusive projects. Project A has cash flows or -$87,000, $32,600, $35,900, and $43,400 for years 0 to 3, respectively. Project has cash flows of -$85,000, $14,700, $21,200, and $89,800 for years 0 to 3, respectively. Project A has a required return of 9 percent while Project B's required return is 11 percent. Which project(s), if either, should you accept based on net present value? Multiple Choice Reject Project A and accept Project Accept Project A and reject Projecte accept Either one, but not both Reject both projects Accept both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts