Question: If a firm takes steps that increase its expected future ROE, its stock price will Increase Based on your understanding of the uses and limitations

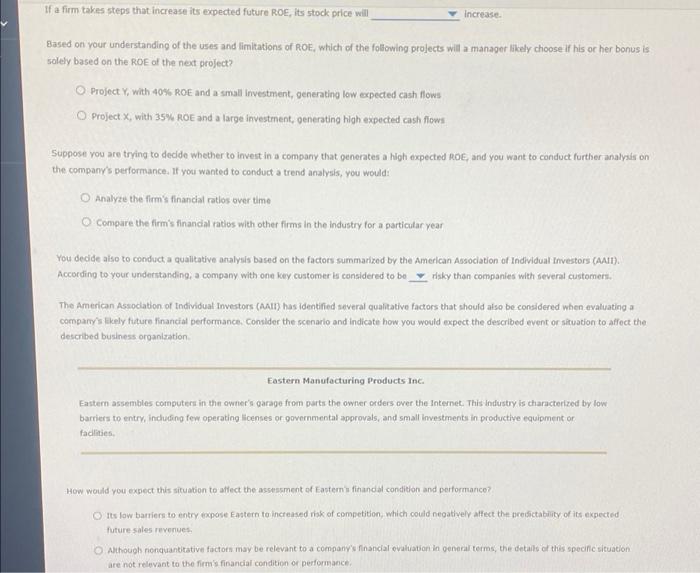

If a firm takes steps that increase its expected future ROE, its stock price will Increase Based on your understanding of the uses and limitations of Rot, which of the following projects will a manager likely choose If his or her bonus is solely based on the ROE of the next project? O Project, with 40% ROE and a small Investment, generating low expected cash flows O Project X, with 35% ROE and a large investment, generating high expected cash flows Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a trend analysis, you would: Analyze the firm's finandal ratlos over time O compare the firm's finandal ratios with other firms in the industry for a particular year a You decide also to conducta qualitative analysis based on the factors summarized by the American Association of Individual Investors (AIT). According to your undetstanding a company with one key customer la considered to bo_risky than companies with several customers. The American Association of Individual Investors (AA) has identified several qualitative factors that should also be considered when evaluating a company's likely tuture Financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization Eastern Manufacturing Products Inc. Eastern assembles computers in the owner's garage from parts the owner orders over the Internet. This Industry is characterized by low barriers to entry, including few operating licenses or governmental approvals, and small investments in productive equipment or facilities How would you expect this situation to affect the assessment of Easter's financial condition and performance? Its low barriers to entry expose Eastern to increased risk of competition, which could negatively affect the predictability of its expected future sales revenues Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firms financial condition of performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts