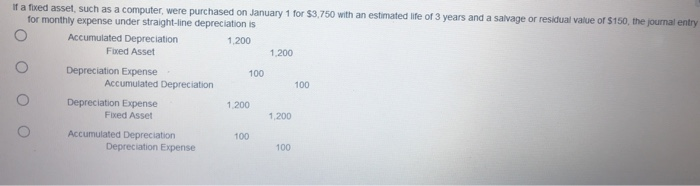

Question: If a fixed asset, such as a computer, were purchased on January 1 for $3.750 with an estimated life of 3 years and a salvage

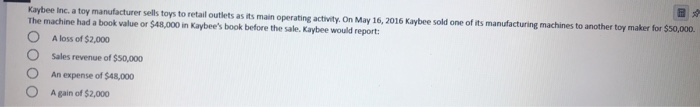

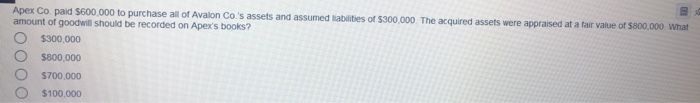

If a fixed asset, such as a computer, were purchased on January 1 for $3.750 with an estimated life of 3 years and a salvage or residual value of $150, the journal entry for monthly expense under straight-line depreciation is Accumulated Depreciation 1,200 Fixed Asset 1,200 Depreciation Expense 100 Accumulated Depreciation 100 Depreciation Expense 1.200 Fixed Asset 1,200 Accumulated Depreciation Depreciation Expense 100 100 Kaybee Inc. a toy manufacturer sells toys to retail outlets as its main operating activity. On May 16, 2016 Kaybee sold one of its manufacturing machines to another toy maker for $50,000 The machine had a book value or $48,000 in Kaybee's book before the sale. Kaybee would report: A loss of $2,000 Sales revenue of $50,000 An expense of $48,000 A gain of $2,000 Apex Co. paid $600,000 to purchase all of Avalon Co.'s assets and assumed liabilities of $300,000. The acquired assets were appraised at a fair value of $800,000 What amount of goodwill should be recorded on Apex's books? $300.000 $800.000 $700.000 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts