Question: If a loan is repaid, the lender does not have to include the principal portion of the payment in gross income. There is no exclusion

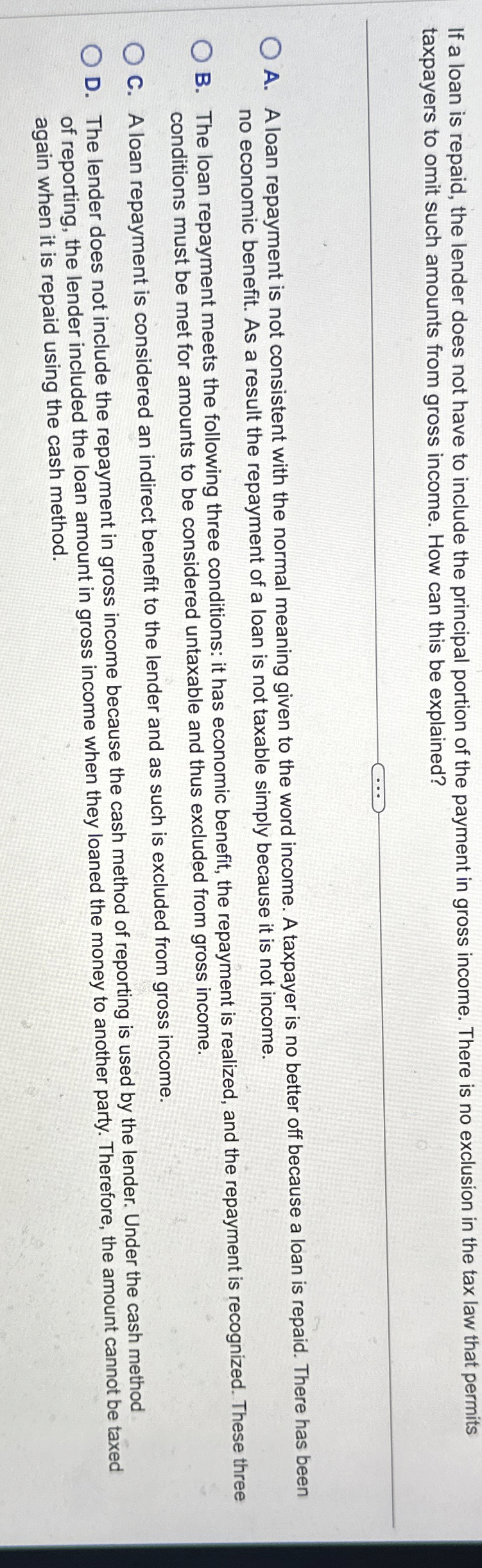

If a loan is repaid, the lender does not have to include the principal portion of the payment in gross income. There is no exclusion in the tax law that permits

taxpayers to omit such amounts from gross income. How can this be explained?

A A loan repayment is not consistent with the normal meaning given to the word income. A taxpayer is no better off because a loan is repaid. There has been

no economic benefit. As a result the repayment of a loan is not taxable simply because it is not income.

B The loan repayment meets the following three conditions: it has economic benefit, the repayment is realized, and the repayment is recognized. These three

conditions must be met for amounts to be considered untaxable and thus excluded from gross income.

C A loan repayment is considered an indirect benefit to the lender and as such is excluded from gross income.

D The lender does not include the repayment in gross income because the cash method of reporting is used by the lender. Under the cash method

of reporting, the lender included the loan amount in gross income when they loaned the money to another party. Therefore, the amount cannot be taxed

again when it is repaid using the cash method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock