Question: If a project has a 5-year life, requires an initial investment of $200,000, and is expected to yield annual cash flows of $60,000, what is

If a project has a 5-year life, requires an initial investment of $200,000, and is expected to yield annual cash flows of $60,000, what is the net present value of the project if the required rate of return is set at 10%? If required, round your answer to the nearest cent.

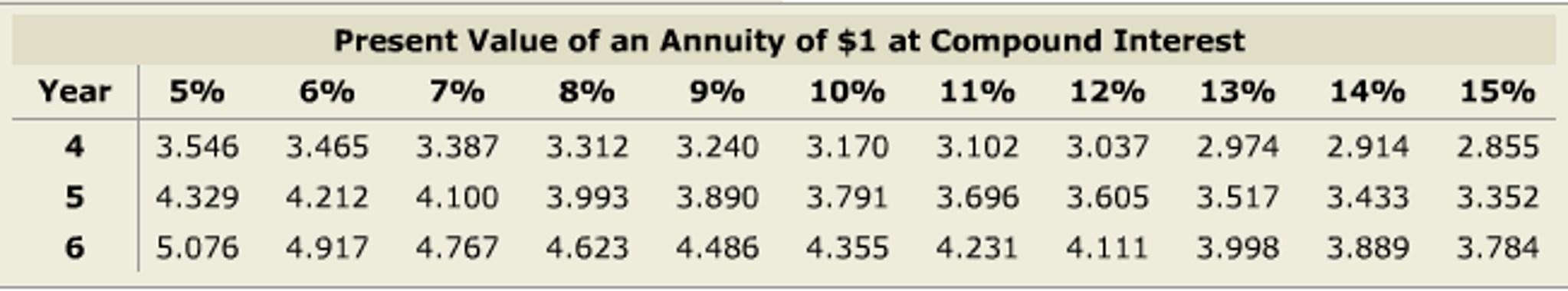

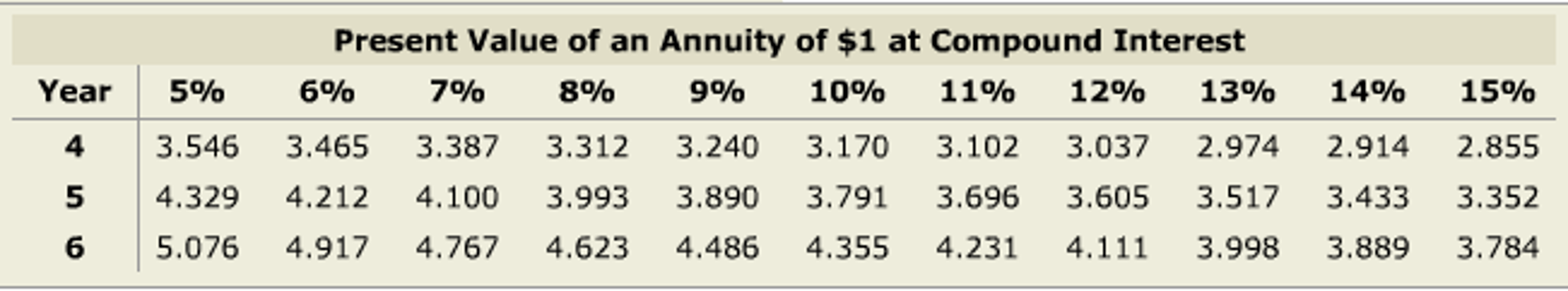

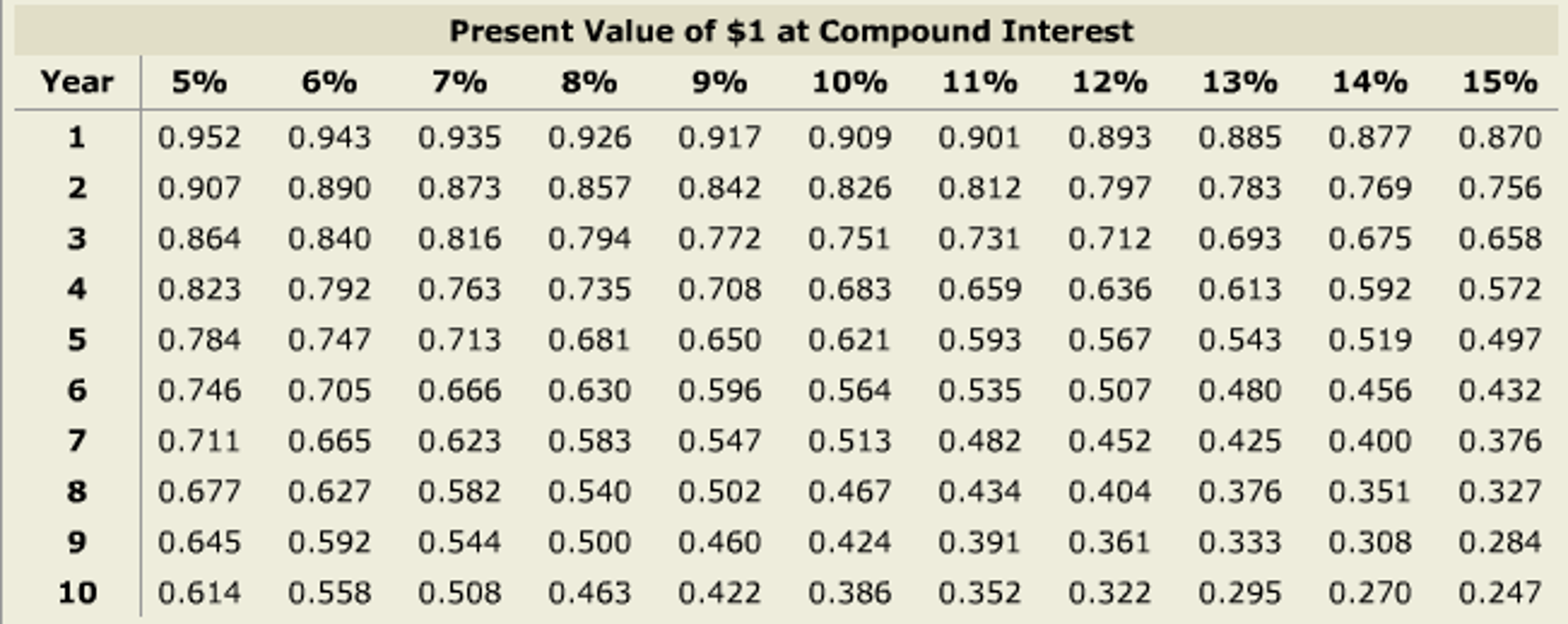

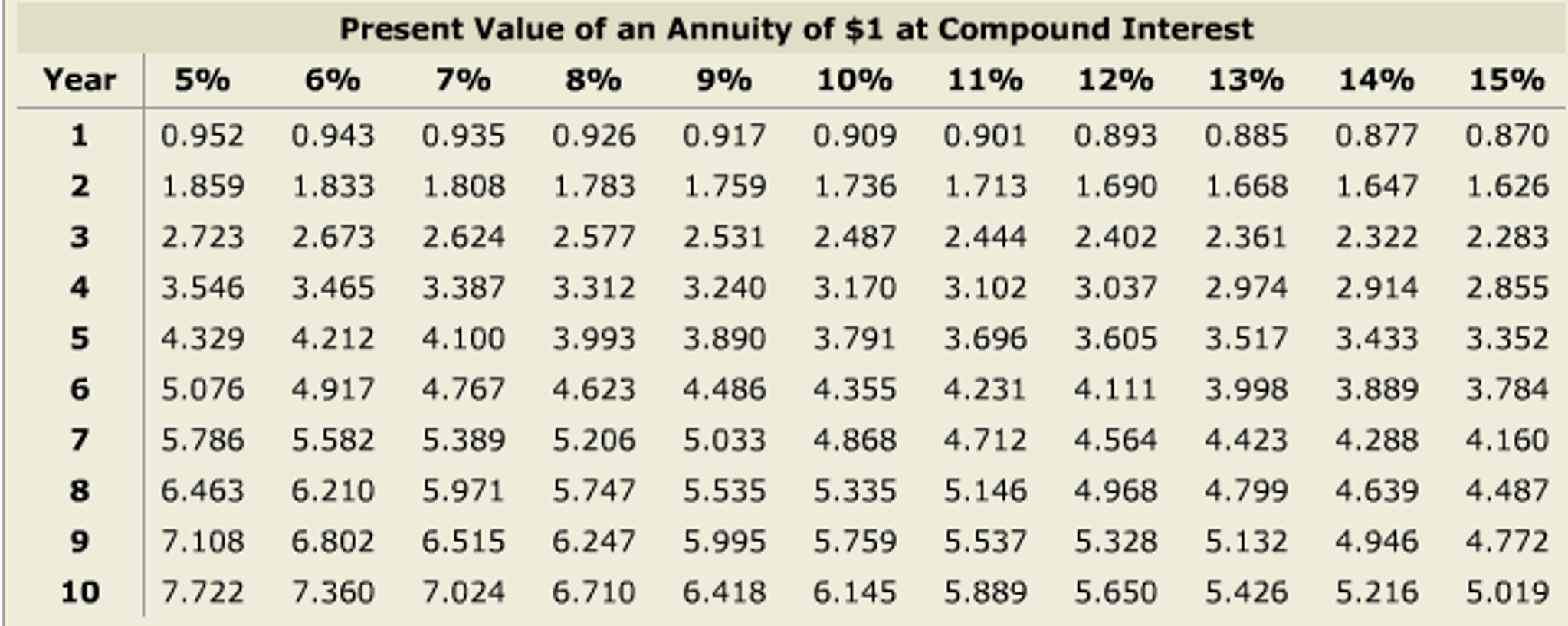

Present Value Tables The Present Value of an Ordinary Annuity is the value of a stream of expected or promised future payments that have been discounted to a single equivalent value today. It is extremely useful for comparing two separate cash flows that differ in some way.

| Net Present Value Computation = | $__?__ | x | (A. 3.791 B. 1.759 C. 3.89) | $? |

What NPV does the previous calculation yield? $___?___

Internal Rate of Return Introduced

The internal rate of return (IRR) method uses present value concepts to compute the rate of return from a capital investment proposal based on its expected net cash flows. This method, sometimes called the time-adjusted rate of return method, starts with the proposal's net cash flows and works backward to estimate the proposal's expected rate of return.

Internal Rate of Return Calculation (Even Cashflows)

| IRR Factor = | Investment |

| Annual cash flows | |

If a project has a 6-year life, requires an initial investment of $189,200, and is expected to yield annual cash flows of $50,000, what is the internal rate of return?

| IRR Factor = | $__?__ | = (A. 3.784 B. 4.355 C. 4.767) |

| $__?__ |

The calculated value corresponds to which percentage in the table for the present value of ordinary annuities?

A. 15% B. 10% C. 7%

APPLY THE CONCEPTS: Net present value

Project A This project requires an initial investment of $139,590. The project will have a life of 4 years. Annual revenues associated with the project will be $90,000 and expenses associated with the project will be $45,000 for an annual net cash flow of $__?__.

Note: Enter cash flows as positive numbers.

| Cash Flows | ||

| Year 0 | -$139,590 | |

| Year 1 | ? | |

| Year 2 | ? | |

| Year 3 | ? | |

| Year 4 | ? | |

Project B This project requires an initial investment of $129,600. The project will have a life of 4 years. Annual revenues associated with the project will be $100,000, and expenses associated with the project will be $60,000, for an annual net cash flow of $___?___.

| Cash Flows | ||

| Year 0 | -$129,600 | |

| Year 1 | ? | |

| Year 2 | ? | |

| Year 3 | ? | |

| Year 4 | ? | |

The cost of capital for the company is 6%.

Present Value Tables:

Use the minus sign to indicate a negative NPV. If an amount is zero, enter "0".

| Project A NPV Analysis | |||||||||

| Year | Cash Flow | Discount Factor | Present Value | ||||||

| 0 | $139,590 | 1.000 | $139,590 | ||||||

| 14 | 45,000 | A. 3.465 B. 0.792 C. 3.24 | ? | ||||||

| NPV | $ ? | ||||||||

| Project B NPV Analysis | |||||||||

| Year | Cash Flow | Discount Factor | Present Value | ||||||

| 0 | $129,600 | 1.000 | $129,600 | ||||||

| 14 | 40,000 | A. 3.465 B. 0.792 C. 3.24 | ? | ||||||

| NPV | $ ? | ||||||||

Based upon net present value, which project has the more favorable profit prospects? A. (Project A) B. (Project B) C. (Either project)

Internal rate of return:

Calculate the internal rate of return for Project A and Project B (defined previously). Enter the IRR with the percent sign (i.e. 4%).

Project A: IRR Analysis

With an initial investment of $139,590 and annual cash flows of $__?__, the internal rate of return for Project A is __?__ .

Project B: IRR Analysis

With an intial investment of $129,600 and annual cash flows of $__?__, the internal rate of return for Project B is __?__ .

Present Value of an Annuity of $1 at Compound Interest 9% 10% 11% 12% 13% 14% 15% 4 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 5 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 6 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 Year 5% 6% 690 7% 7010 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts