Question: If all is corect I will give a thumbs up . 5. Hedging with stock options Suppose that Hyshimi Pension Fund purchased Critico stock at

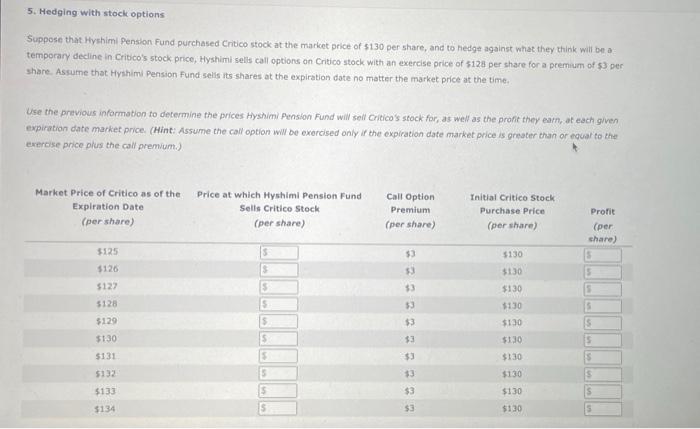

5. Hedging with stock options Suppose that Hyshimi Pension Fund purchased Critico stock at the markcet price of $130 per share, and to hedge against what they think will be a temporary decline in Cribco's stock price, Hyshimi selis call options on Critico stock with an exercise price of $128 per share for a premium of s3 per share. Assume that Hyshimi Pension Fund selis its-shares at the expiration date no matter the market price at the time. Use the previous informstion to determine the prices Hyshimi Pension Fund will seil Critico's stock for, as weil as the profit they earn, at each given expiration date market price. (Hint: Assume the call option wW be exercised only if the expiration date market price is greater than or thuat to the exerose phice piuss the call premum.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts