Question: If an amount is zero, enter 0. Round intermediate computations and final answer to the nearest dollar. Note: Round your percentage computations up to

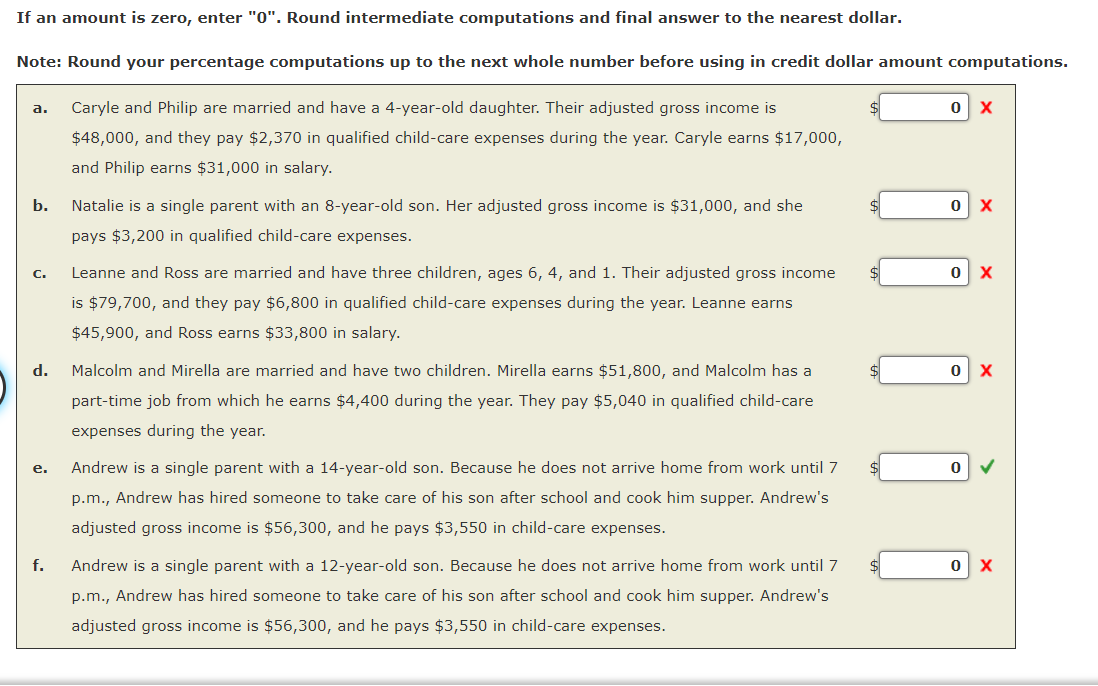

If an amount is zero, enter "0". Round intermediate computations and final answer to the nearest dollar. Note: Round your percentage computations up to the next whole number before using in credit dollar amount computations. . Caryle and Philip are married and have a 4-year-old daughter. Their adjusted gross income is $48,000, and they pay $2,370 in qualified child-care expenses during the year. Caryle earns $17,000, and Philip earns $31,000 in salary. b. Natalie is a single parent with an 8-year-old son. Her adjusted gross income is $31,000, and she pays $3,200 in qualified child-care expenses. . Leanne and Ross are married and have three children, ages 6, 4, and 1. Their adjusted gross income is $79,700, and they pay $6,800 in qualified child-care expenses during the year. Leanne earns $45,900, and Ross earns $33,800 in salary. d. Malcolm and Mirella are married and have two children. Mirella earns $51,800, and Malcolm has a part-time job from which he earns $4,400 during the year. They pay $5,040 in qualified child-care expenses during the year. . Andrew is a single parent with a 14-year-old son. Because he does not arrive home from work until 7 p.m., Andrew has hired someone to take care of his son after school and cook him supper. Andrew's adjusted gross income is $56,300, and he pays $3,550 in child-care expenses. f. Andrew is a single parent with a 12-year-old son. Because he does not arrive home from work until 7 p.m., Andrew has hired someone to take care of his son after school and cook him supper. Andrew's adjusted gross income is $56,300, and he pays $3,550 in child-care expenses.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Solution a Since Philip and Caryles adjusted gross income AGI is in excess of 15000they must reduce the 35 genera l credit by 1 for each 2000 or portion thereof of AGI in excess of 15000The maximum re... View full answer

Get step-by-step solutions from verified subject matter experts