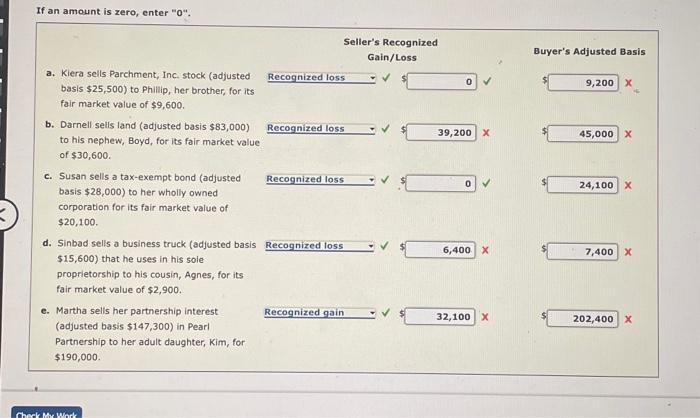

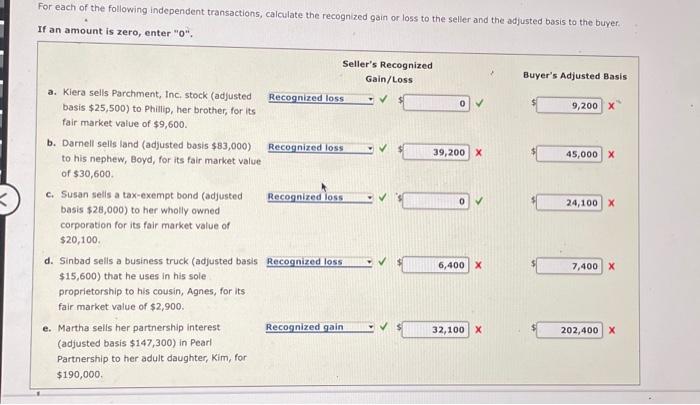

Question: If an amount is zero, enter 0 . Seller's Recognized Gain/Loss a. Kiera sells Parchment, Inc. stock (adjusted basis $25,500 ) to Phillip, her

If an amount is zero, enter " 0 ". Seller's Recognized Gain/Loss a. Kiera sells Parchment, Inc. stock (adjusted basis $25,500 ) to Phillip, her brother, for its fair market value of $9,600. b. Darnell sells land (adjusted basis $83,000 ) to his nephew, Boyd, for its fair market value of $30,600. c. Susan sells a tax-exempt bond (adjusted basis $28,000 ) to her wholly owned corporation for its fair market value of $20,100. d. Sinbad sells a business truck (adjusted basis $15,600 ) that he uses in his sole proprietorship to his cousin, Agnes, for its fair market value of $2,900. e. Martha sells her partnership interest (adjusted basis $147,300 ) in Pearl Partnership to her adult daughter, Kim, for $190,000. Buyer's Adjusted Basis Recognized loss Recognized loss For each of the following independent transactions, calculate the recognized gain or loss to the seller and the adjusted basis to the buyer. If an amount is zero, enter " 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts