Question: If an amount is zero, enter O. a. Determine the amount and the character of the recognized gain or loss from the disposition of each

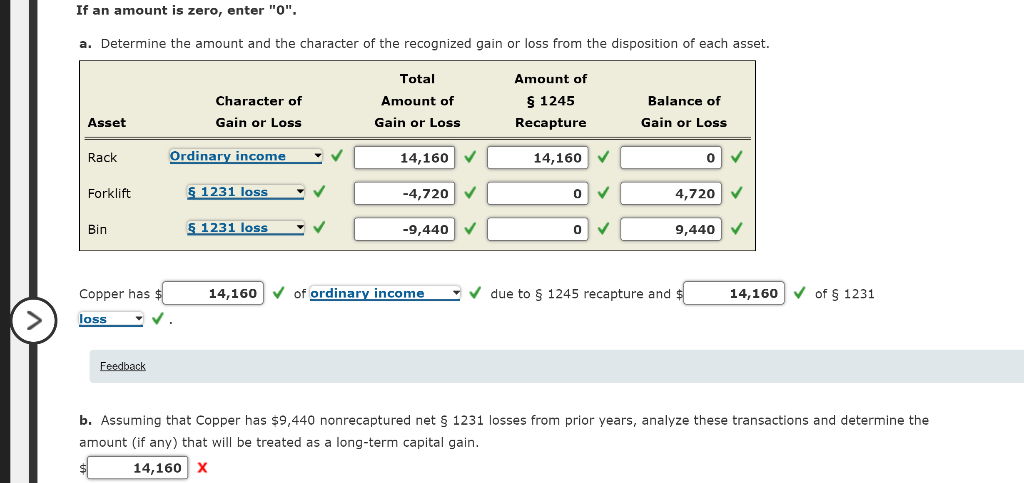

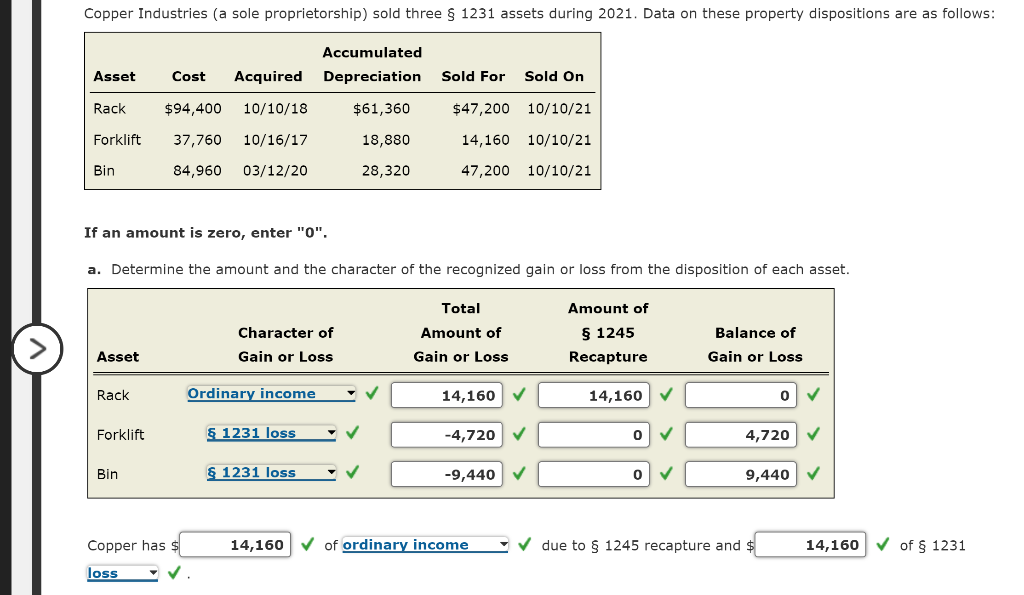

If an amount is zero, enter "O". a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset. Character of Gain or Loss Total Amount of Gain or Loss Amount of $ 1245 Recapture Balance of Gain or Loss Asset Rack Ordinary income 14,160 14,160 0 Forklift $_1231 loss -4,720 0 4,720 Bin 5 1231 loss -9,440 0 9,440 14,160 of ordinary income due to 1245 recapture and $ 14,160 of 1231 Copper has $ loss > Feedback b. Assuming that Copper has $9,440 nonrecaptured net 1231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain. 14,160 X Copper Industries (a sole proprietorship) sold three 1231 assets during 2021. Data on these property dispositions are as follows: Accumulated Depreciation Asset Cost Acquired Sold For Sold On Rack $94,400 10/10/18 $61,360 $47,200 10/10/21 Forklift 37,760 10/16/17 18,880 14,160 10/10/21 Bin 84,960 03/12/20 28,320 47,200 10/10/21 If an amount is zero, enter "0". a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset. Amount of Character of Gain or Loss Total Amount of Gain or Loss $ 1245 Balance of Gain or Loss Asset Recapture Rack Ordinary income 14,160 14,160 0 Forklift $ 1231 loss -4,720 0 4,720 Bin 1231 loss -9,440 0 9,440 14,160 of ordinary income due to $ 1245 recapture and $ 14,160 of 1231 Copper has $ loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts