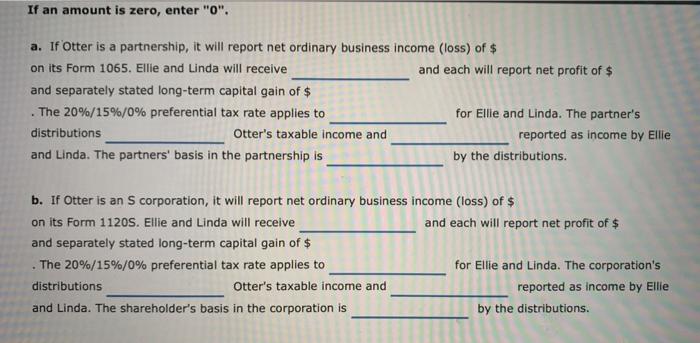

Question: If an amount is zero, enter O. a. If Otter is a partnership, it will report net ordinary business income (loss) of $ on its

If an amount is zero, enter "O". a. If Otter is a partnership, it will report net ordinary business income (loss) of $ on its Form 1065. Ellie and Linda will receive and each will report net profit of $ and separately stated long-term capital gain of $ The 20%/15%/0% preferential tax rate applies to for Ellie and Linda. The partner's distributions Otter's taxable income and reported as income by Ellie and Linda. The partners' basis in the partnership is by the distributions. b. If Otter is an s corporation, it will report net ordinary business income (loss) of $ on its Form 11205. Ellie and Linda will receive and each will report net profit of $ and separately stated long-term capital gain of $ . The 20%/15%/0% preferential tax rate applies to for Ellie and Linda. The corporation's distributions Otter's taxable income and reported as income by Ellie and Linda. The shareholder's basis in the corporation is by the distributions. If an amount is zero, enter "O". a. If Otter is a partnership, it will report net ordinary business income (loss) of $ on its Form 1065. Ellie and Linda will receive and each will report net profit of $ and separately stated long-term capital gain of $ The 20%/15%/0% preferential tax rate applies to for Ellie and Linda. The partner's distributions Otter's taxable income and reported as income by Ellie and Linda. The partners' basis in the partnership is by the distributions. b. If Otter is an s corporation, it will report net ordinary business income (loss) of $ on its Form 11205. Ellie and Linda will receive and each will report net profit of $ and separately stated long-term capital gain of $ . The 20%/15%/0% preferential tax rate applies to for Ellie and Linda. The corporation's distributions Otter's taxable income and reported as income by Ellie and Linda. The shareholder's basis in the corporation is by the distributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts