Question: if anyone can help explain this with work please. I can't seem to get the right answer with the proper work 1 pts Question 1

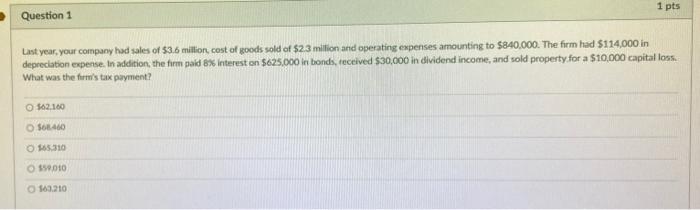

1 pts Question 1 Last year, your company had sales of $3.6 million cost of goods sold of $2.3 million and operating expenses amounting to $840,000. The firm had $114,000 in depreciation expense. In addition, the firm paid 8% interest on $625,000 in bonds, received $30,000 in dividend income, and sold property for a $10,000 capital loss What was the firm's tax payment? 562.100 SOLO 5310 550.000 63.210

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts