Question: If anyone could provide an answer with a brief explanation I would greatly appreciate it :) B D E F G H 1 CCNY, Inc.

If anyone could provide an answer with a brief explanation I would greatly appreciate it :)

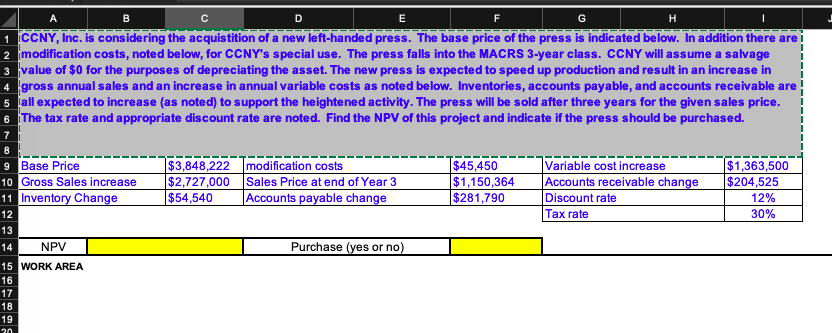

B D E F G H 1 CCNY, Inc. is considering the acquistition of a new left-handed press. The base price of the press is indicated below. In addition there are 2 modification costs, noted below, for CCNY's special use. The press falls into the MACRS 3-year class. CCNY will assume a salvage 3 value of $0 for the purposes of depreciating the asset. The new press is expected to speed up production and result in an increase in 4 gross annual sales and an increase in annual variable costs as noted below. Inventories, accounts payable, and accounts receivable are 5 all expected to increase (as noted) to support the heightened activity. The press will be sold after three years for the given sales price. 6 The tax rate and appropriate discount rate are noted. Find the NPV of this project and indicate if the press should be purchased. 7 8 9 Base Price 10 Gross Sales increase 11 Inventory Change 12 13 14 NPV $3,848,222 modification costs $2,727,000 Sales Price at end of Year 3 $54,540 Accounts payable change $45,450 $1,150,364 $281,790 Variable cost increase Accounts receivable change Discount rate Tax rate $1,363,500 $204,525 12% 30% Purchase (yes or no) 15 WORK AREA 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts