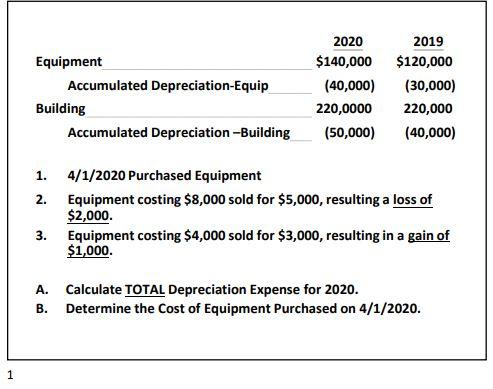

Question: If calculated using Excel please include the excel-formulas used!!! Thank you!!! Equipment Accumulated Depreciation-Equip Building Accumulated Depreciation -Building 2020 $140,000 (40,000) 220,0000 (50,000) 2019 $120,000

If calculated using Excel please include the excel-formulas used!!!

Thank you!!!

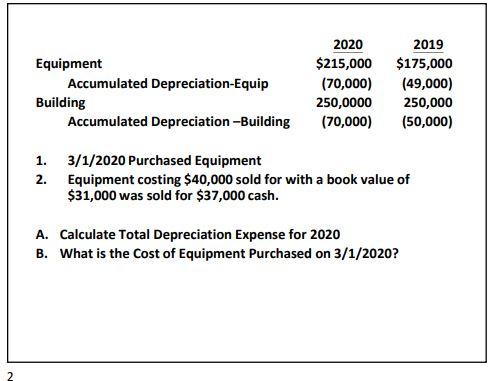

Equipment Accumulated Depreciation-Equip Building Accumulated Depreciation -Building 2020 $140,000 (40,000) 220,0000 (50,000) 2019 $120,000 (30,000) 220,000 (40,000) 2. 1. 4/1/2020 Purchased Equipment Equipment costing $8,000 sold for $5,000, resulting a loss of $2,000. Equipment costing $4,000 sold for $3,000, resulting in a gain of $1,000. 3. A. Calculate TOTAL Depreciation Expense for 2020. B. Determine the cost of Equipment Purchased on 4/1/2020. 1 Equipment Accumulated Depreciation-Equip Building Accumulated Depreciation Building 2020 $215,000 (70,000) 250,0000 (70,000) 2019 $175,000 (49,000) 250,000 (50,000) 1. 3/1/2020 Purchased Equipment 2. Equipment costing $40,000 sold for with a book value of $31,000 was sold for $37,000 cash. A. Calculate Total Depreciation Expense for 2020 B. What is the Cost of Equipment Purchased on 3/1/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts