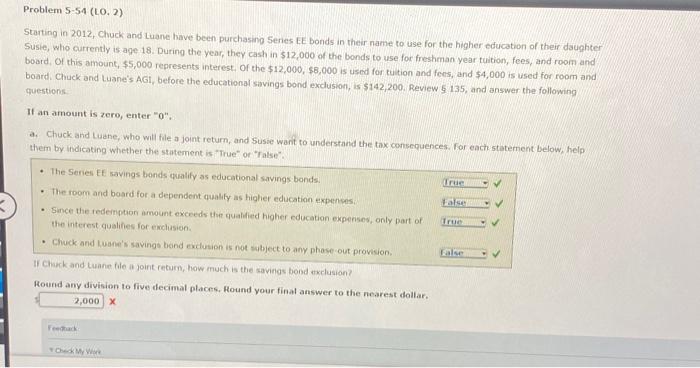

Question: If Chuck and Luane file a joint return, how much is the savings bond exclusion? Round any division to five decimal places. Round your final

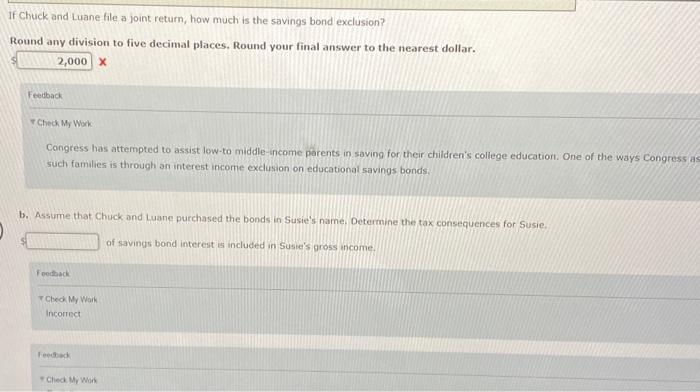

If Chuck and Luane file a joint return, how much is the savings bond exclusion? Round any division to five decimal places. Round your final answer to the nearest dollar. x Feedback TCheck My Work Congress has attempted to assist low-to middle-income parents in saving for their children's college education. One of the ways Congress a such families is through an interest income exclusion on educationaf savings bonds. b. Assume that Chuck and Luane purchased the bonds in Susie's name. Determine the tax consequences for Susie. of savings bond interest is included in susse's gross income. Foedack TCleck My Waik Incorrect fepsiad r Cleded Mr Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts