Question: if could be shown how to be done through excel, would be very helpful. You are considering the purchase of a 120 -unit apartment complex.

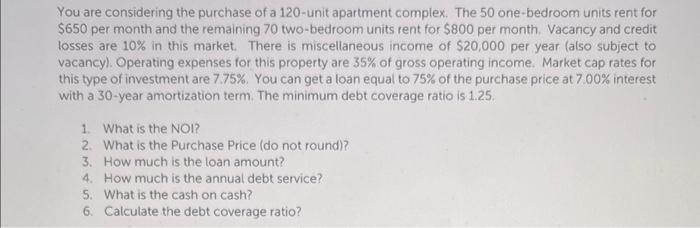

You are considering the purchase of a 120 -unit apartment complex. The 50 one-bedroom units rent for $650 per month and the remaining 70 two-bedroom units rent for $800 per month. Vacancy and credit losses are 10% in this market. There is miscellaneous income of $20,000 per year lalso subject to vacancy). Operating expenses for this property are 35% of gross operating income. Market cap rates for this type of investment are 7.75\%. You can get a loan equal to 75% of the purchase price at 7.00% interest with a 30-year amortization term. The minimum debt coverage ratio is 1.25. 1. What is the NOI? 2. What is the Purchase Price (do not round)? 3. How much is the loan amount? 4. How much is the annual debt service? 5. What is the cash on cash? 6. Calculate the debt coverage ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts