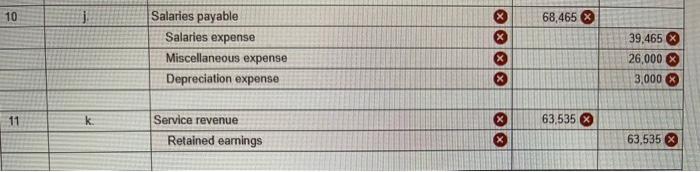

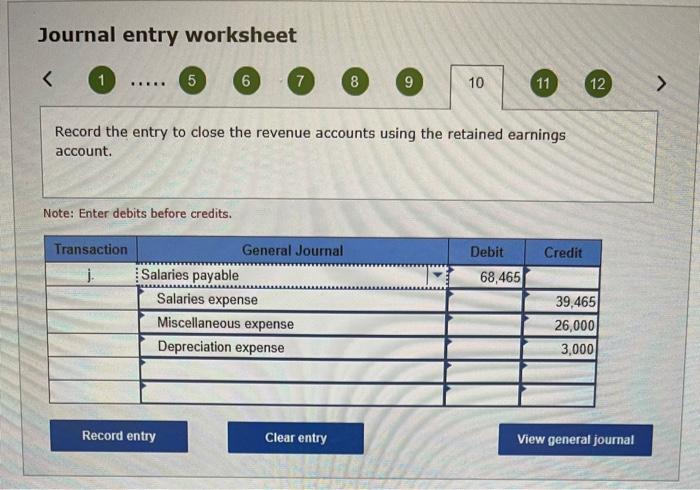

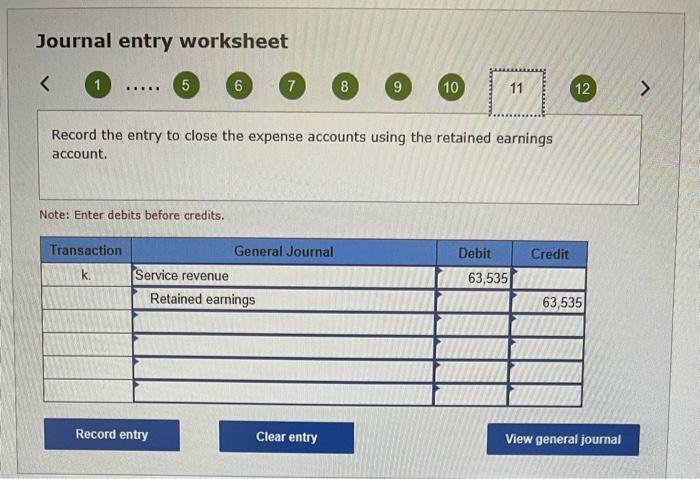

Question: if could please help only on the journal entry worksheet 10 & 11 where the red x indicates incorrect. The other entries I was able

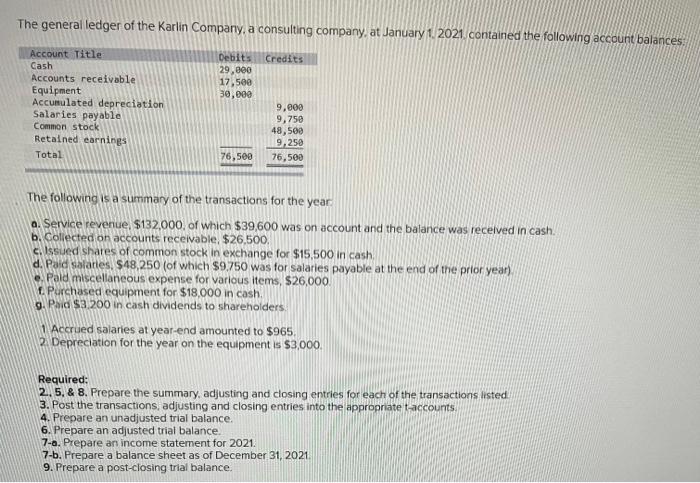

Journal entry worksheet (1) 11 Record the entry to close the revenue accounts using the retained earnings account. Note: Enter debits before credits. Journal entry worksheet 1 5 7 Record the entry to close the expense accounts using the retained earnings account. Note: Enter debits before credits. The general ledger of the Karlin Company, a consulting company, at January 1.2021. contained the following account balances. The following is a summary of the transactions for the year a. Service revenue, $132,000, of which $39,600 was on account and the balance was recelved in cash. b. Coliected on accounts receivable, $26,500 c. Issued shates of common stock in exchange for $15,500 in cash d. Paic salaries, $48,250 (of which $9.750 was for salaries payable at the end of the prior year) e. Pald miscellaneous expense for various items, $26,000 f. Pirchased equipment for $18.000 in cash. 9. Paid $3.200 in cash dividends to sharehoiders. 1. Accrued salaries at year-end amounted to $965. 2. Depreciation for the year on the equipment is $3,000 Required: 2. 5, \& 8. Prepare the summary, adjusting and closing entries for each of the transactions listed 3. Post the transactions, adjusting and closing entries into the appropriate taccourts. 4. Prepare an unadjusted trial balance. 6. Prepare an adjusted trial balance 7-o. Prepare an income statement for 2021. 7-b. Prepare a balance sheet as of December 31, 2021 9. Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts