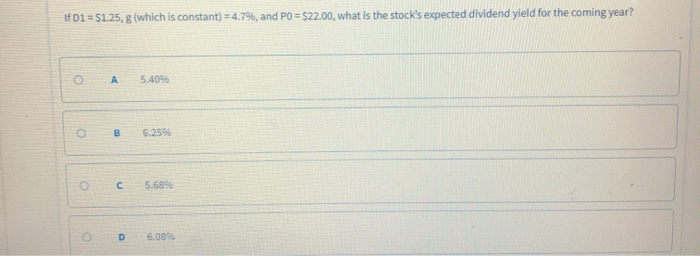

Question: if D1 = $1.25, g (which is constant) = 4.7%, and PO = $22.00, what is the stock's expected dividend yield for the coming year?

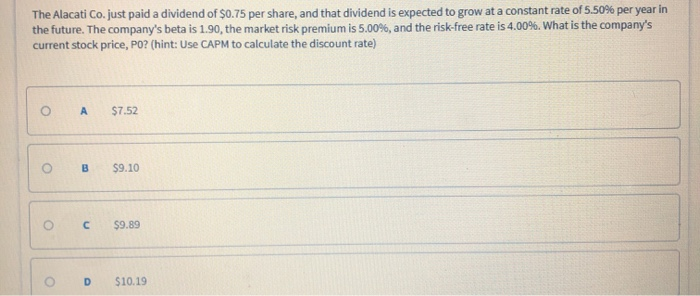

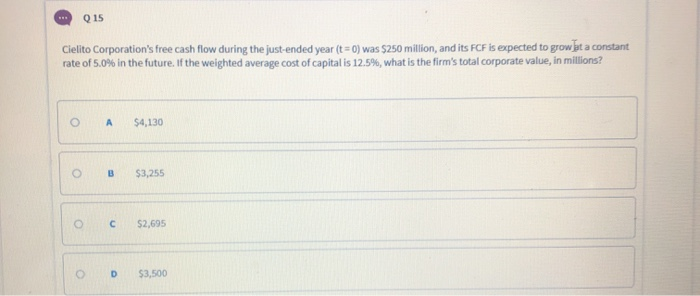

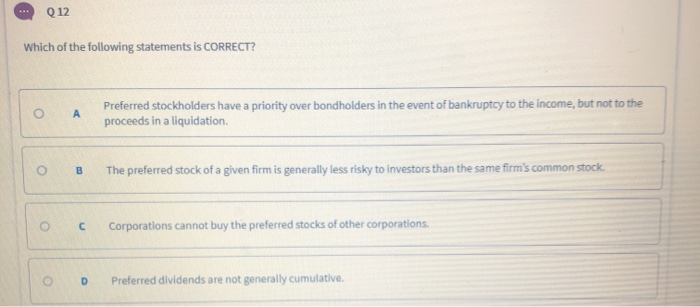

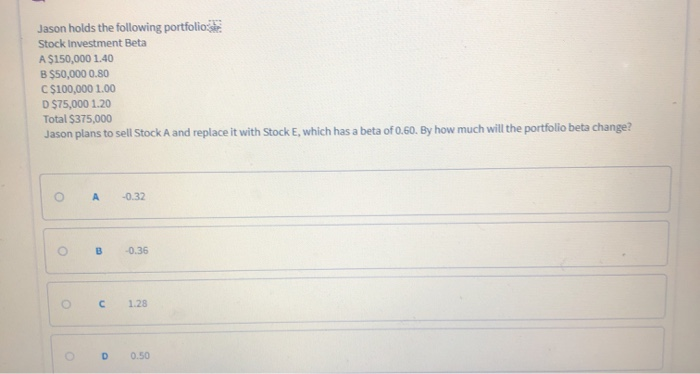

if D1 = $1.25, g (which is constant) = 4.7%, and PO = $22.00, what is the stock's expected dividend yield for the coming year? O A 5.40% B 6 .25% 5.6896 O D 6.0890 The Alacati Co.just paid a dividend of $0.75 per share, and that dividend is expected to grow at a constant rate of 5.50% per year in the future. The company's beta is 1.90, the market risk premium is 5.00%, and the risk-free rate is 4.00%. What is the company's current stock price, Po? (hint: Use CAPM to calculate the discount rate O A $7.52 o B $9.10 O C $9.89 O D $10.19 15 Cielito Corporation's free cash flow during the just-ended year (t =0) was $250 million, and its FCF is expected to grow hat a constant rate of 5.0% in the future. If the weighted average cost of capital is 12.5%, what is the firm's total corporate value, in millions? O A $4,130 O B $3,255 o c $2,695 O D $3,500 Q12 Which of the following statements is CORRECT? Preferred stockholders have a priority over bondholders in the event of bankruptcy to the income, but not to the proceeds in a liquidation B The preferred stock of a given firm is generally less risky to investors than the same firm's common stock O C Corporations cannot buy the preferred stocks of other corporations. O D Preferred dividends are not generally cumulative, Jason holds the following portfolio Stock Investment Beta A $150,000 1.40 B$50,000 0.80 C$100,000 1.00 D $75,000 1.20 Total $375,000 Jason plans to sell Stock A and replace it with Stock E, which has a beta of 0.60. By how much will the portfolio beta change? O A -0.32 O B 0.36 O C 1.28 O D 0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts