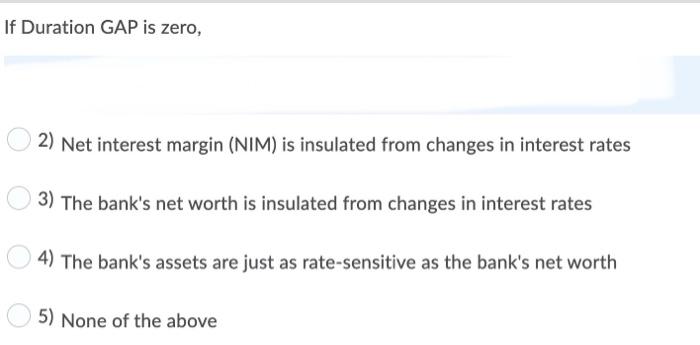

Question: If Duration GAP is zero, 2) Net interest margin (NIM) is insulated from changes in interest rates 3) The bank's net worth is insulated from

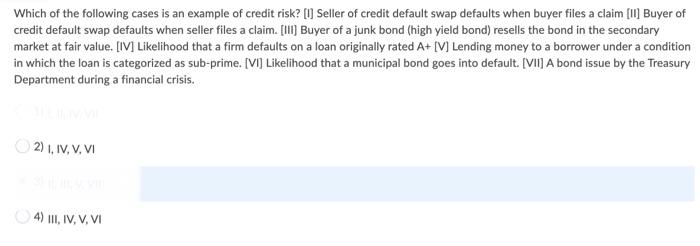

If Duration GAP is zero, 2) Net interest margin (NIM) is insulated from changes in interest rates 3) The bank's net worth is insulated from changes in interest rates 4) The bank's assets are just as rate-sensitive as the bank's net worth 5) None of the above Which of the following cases is an example of credit risk? [] Seller of credit default swap defaults when buyer files a claim [II] Buyer of credit default swap defaults when seller files a claim.[III] Buyer of a junk bond (high yield bond) resells the bond in the secondary market at fair value. [IV] Likelihood that a firm defaults on a loan originally rated A+ [V] Lending money to a borrower under a condition in which the loan is categorized as sub-prime. [VI] Likelihood that a municipal bond goes into default. [VII] A bond issue by the Treasury Department during a financial crisis. 2) I, IV, V, VI 4) III, IV, V, VI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts