Question: if false please say why. 1.Modified True/False (60 points, 3 points each) The following statements in this section may be true (T) of false (F).

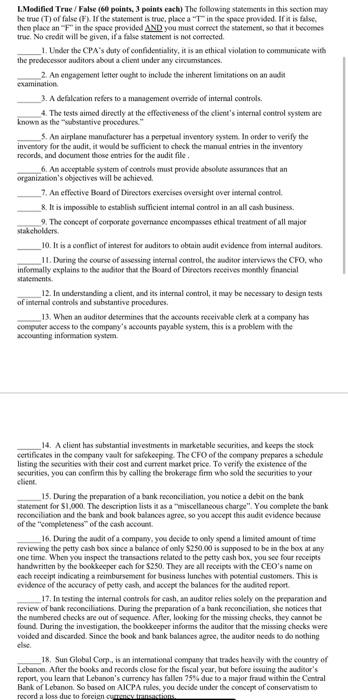

1.Modified True/False (60 points, 3 points each) The following statements in this section may be true (T) of false (F). If the statement is true, place a "Tin the space provided. If it is false, then place an "F" in the space provided AND you must correct the statement, so that it becomes true. No credit will be given, if a false statement is not corrected. 1. Under the CPA's duty of confidentiality, it is an ethical violation to communicate with the predecessor auditors about a client under any circumstances. 2. An engagement letter ought to include the inherent limitations on an audit examination. 3. A defalcation refers to a management override of internal controls. 4. The tests aimed directly at the effectiveness of the client's internal control system are known as the "substantive procedures." 5. An airplane manufacturer has a perpetual inventory system. In order to verify the inventory for the audit, it would be sufficient to check the manual entries in the inventory records, and document those entries for the audit file. 6. An acceptable system of controls must provide absolute assurances that an organization's objectives will be achieved. 7. An effective Board of Directors exercises oversight over internal control. 8. It is impossible to establish sufficient internal control in an all cash business. 9. The concept of corporate governance encompasses ethical treatment of all major stakeholders. 10. It is a conflict of interest for auditors to obtain audit evidence from internal auditors. 11. During the course of assessing internal control, the auditor interviews the CFO, who informally explains to the auditor that the Board of Directors receives monthly financial statements. 12. In understanding a client, and its internal control, it may be necessary to design tests of internal controls and substantive procedures. 13. When an auditor determines that the accounts receivable clerk at a company has computer access to the company's accounts payable system, this is a problem with the accounting information system 14. A client has substantial investments in marketable securities, and keeps the stock certificates in the company vaalt for safekeeping. The CFO of the company prepares a schedule listing the securities with their cost and current market price. To verify the existence of the securities, you can confirm this by calling the brokerage firm who sold the securities to your client. 15. During the preparation of a bank reconciliation, you notice a debit on the bank statement for $1,000. The description lists it as a "miscellaneous charge". You complete the bank reconciliation and the bank and book balances agree, so you accept this audit evidence because of the "completeness of the cash account. 16. During the audit of a company, you decide to only spend a limited amount of time reviewing the petty cash box since a balance of only $250.00 is supposed to be in the box at any one time. When you inspect the transactions related to the petty cash box, you see four receipts handwritten by the bookkeeper each for $250. They are all receipts with the CEO's name on each receipt indicating a reimbursement for business lunches with potential customers. This is evidence of the accuracy of petty cash, and accept the balances for the audited report 17. In testing the internal controls for cash, an auditor relies solely on the preparation and review of bank reconciliations. During the preparation of a bank reconciliation, she notices that the numbered checks are out of sequence. After, looking for the missing checks, they cannot be found. During the investigation, the bookkeeper informs the auditor that the missing checks were voided and discarded. Since the book and bank balances agree, the auditor needs to do nothing else. 18, Sun Global Corp., is an international company that trades heavily with the country of Lebanon. After the books and records close for the fiscal year, but before issuing the auditor's report, you learn that Lebanon's currency has fallen 75% due to a major fraud within the Central Bank of Lebanon. So based on AICPA rules, you decide under the concept of conservatism to record a loss due to foreign currency transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts