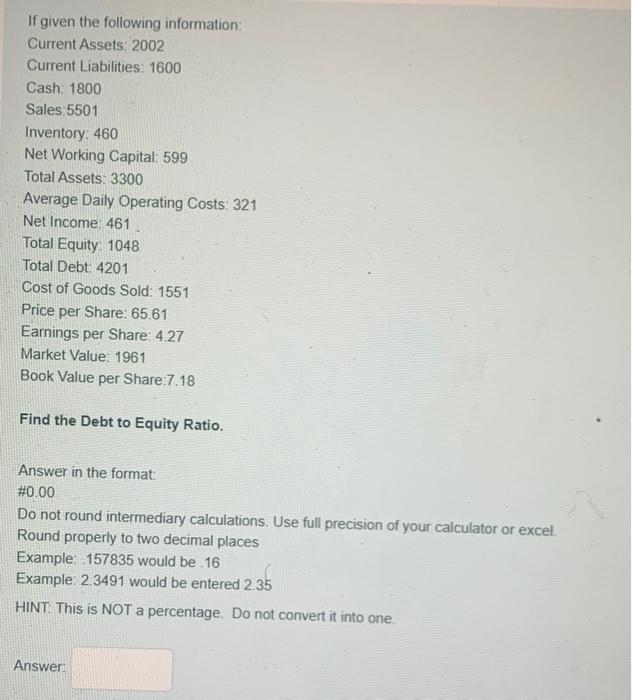

Question: If given the following information: Current Assets: 2002 Current Liabilities: 1600 Cash; 1800 Sales:5501 Inventory: 460 Net Working Capital: 599 Total Assets: 3300 Average Daily

If given the following information: Current Assets: 2002 Current Liabilities: 1600 Cash; 1800 Sales:5501 Inventory: 460 Net Working Capital: 599 Total Assets: 3300 Average Daily Operating Costs: 321 Net Income: 461 Total Equity 1048 Total Debt: 4201 Cost of Goods Sold: 1551 Price per Share: 65.61 Earnings per Share: 4.27 Market Value: 1961 Book Value per Share:7.18 Find the Debt to Equity Ratio. Answer in the format: #0.00 Do not round intermediary calculations. Use full precision of your calculator or excel Round properly to two decimal places Example: 157835 would be 16 Example: 2.3491 would be entered 2.35 HINT. This is NOT a percentage. Do not convert it into one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts