Question: If Hormel did not have any permanent differences, what would the income tax have been in fiscal year 2016? Note K Income Taxes The components

If Hormel did not have any permanent differences, what would the income tax have been in fiscal year 2016?

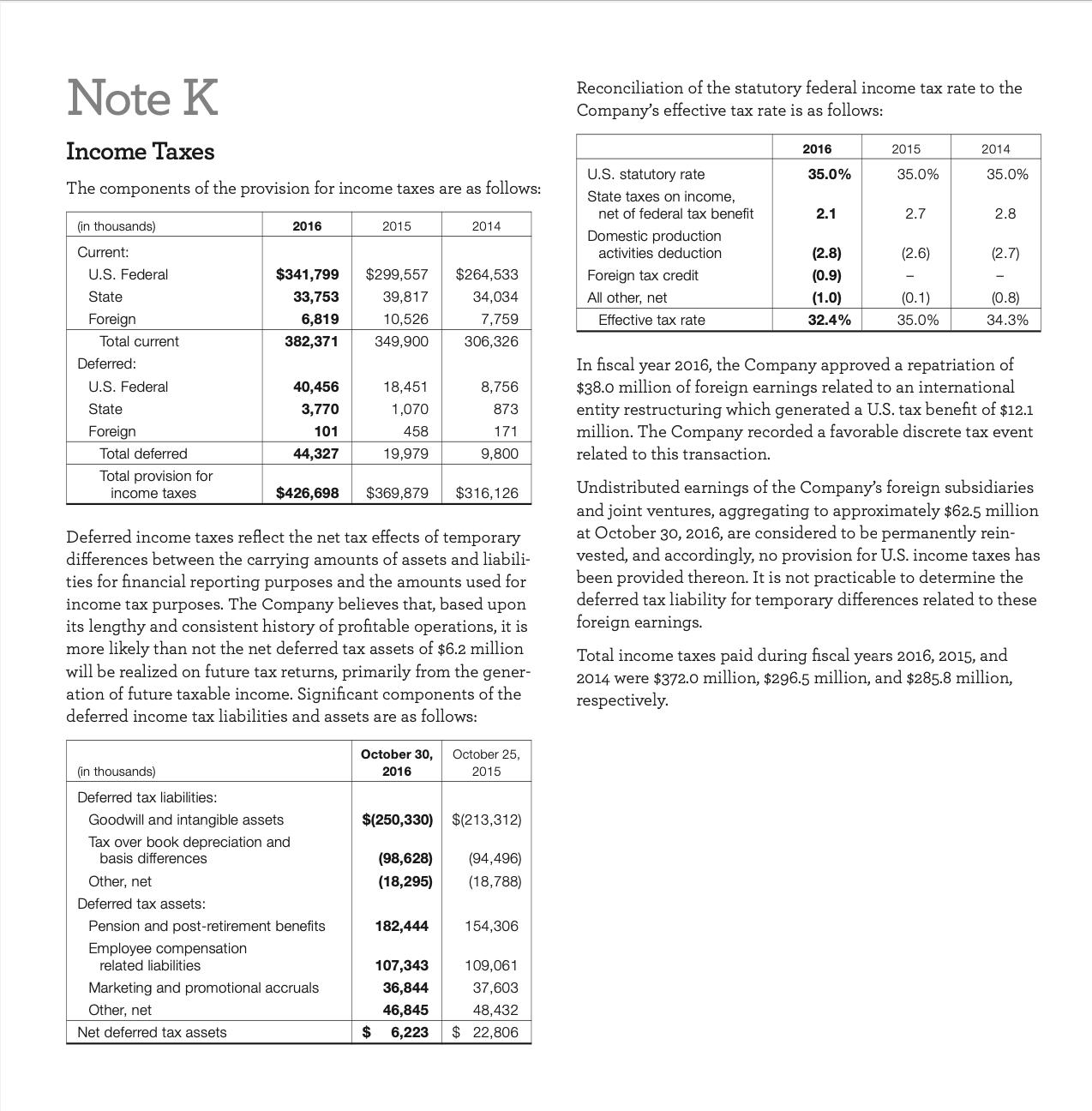

Note K Income Taxes The components of the provision for income taxes are as follows: (in thousands) Current: U.S. Federal State Foreign Total current Deferred: U.S. Federal State Foreign Total deferred Total provision for income taxes 2016 $341,799 33,753 6,819 382,371 Other, net Deferred tax assets: (in thousands) Deferred tax liabilities: Goodwill and intangible assets Tax over book depreciation and basis differences 40,456 3,770 101 44,327 $426,698 2015 Pension and post-retirement benefits Employee compensation related liabilities Marketing and promotional accruals Other, net Net deferred tax assets $299,557 39,817 10,526 349,900 18,451 1,070 458 19,979 $369,879 2014 Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabili- ties for financial reporting purposes and the amounts used for income tax purposes. The Company believes that, based upon its lengthy and consistent history of profitable operations, it is more likely than not the net deferred tax assets of $6.2 million will be realized on future tax returns, primarily from the gener- ation of future taxable income. Significant components of the deferred income tax liabilities and assets are as follows: $264,533 34,034 7,759 306,326 8,756 873 171 9,800 182,444 $316,126 October 30, October 25, 2016 2015 $(250,330) $(213,312) (98,628) (94,496) (18,295) (18,788) 154,306 107,343 109,061 36,844 37,603 46,845 48,432 $ 6,223 $ 22,806 Reconciliation of the statutory federal income tax rate to the Company's effective tax rate is as follows: U.S. statutory rate State taxes on income, net of federal tax benefit Domestic production activities deduction Foreign tax credit All other, net Effective tax rate 2016 35.0% 2.1 (2.8) (0.9) (1.0) 32.4% 2015 35.0% 2.7 (2.6) (0.1) 35.0% 2014 35.0% 2.8 (2.7) (0.8) 34.3% In fiscal year 2016, the Company approved a repatriation of $38.0 million of foreign earnings related to an international entity restructuring which generated a U.S. tax benefit of $12.1 million. The Company recorded a favorable discrete tax event related to this transaction. Undistributed earnings of the Company's foreign subsidiaries and joint ventures, aggregating to approximately $62.5 million at October 30, 2016, are considered to be permanently rein- vested, and accordingly, no provision for U.S. income taxes has been provided thereon. It is not practicable to determine the deferred tax liability for temporary differences related to these foreign earnings. Total income taxes paid during fiscal years 2016, 2015, and 2014 were $372.0 million, $296.5 million, and $285.8 million, respectively.

Step by Step Solution

There are 3 Steps involved in it

To calculate the income tax for fiscal year 2016 we need to consider the information provided in the ... View full answer

Get step-by-step solutions from verified subject matter experts