Question: If I could get some help that'd be great! I'll like/thumbs up the answer! 4 2.08 points 04.13.02 Book References Exercise 8-15 (Algo) Direct Labor

If I could get some help that'd be great!

I'll like/thumbs up the answer!

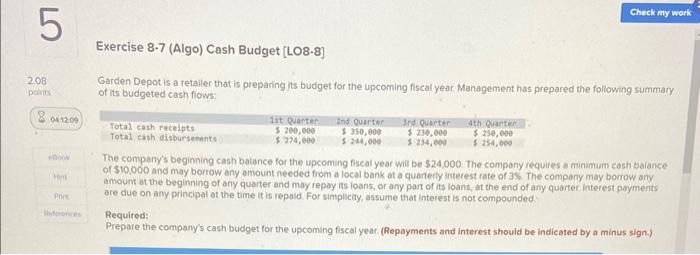

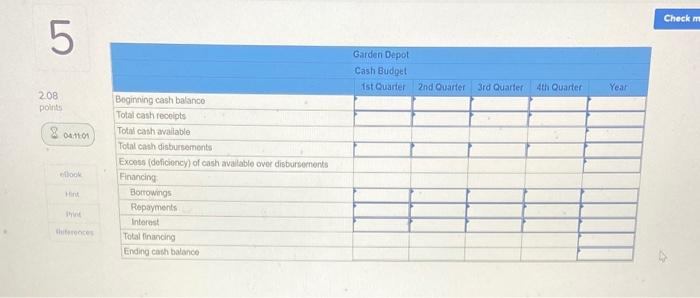

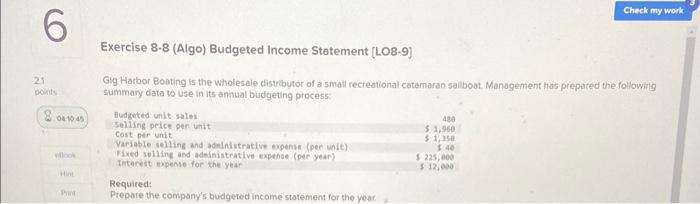

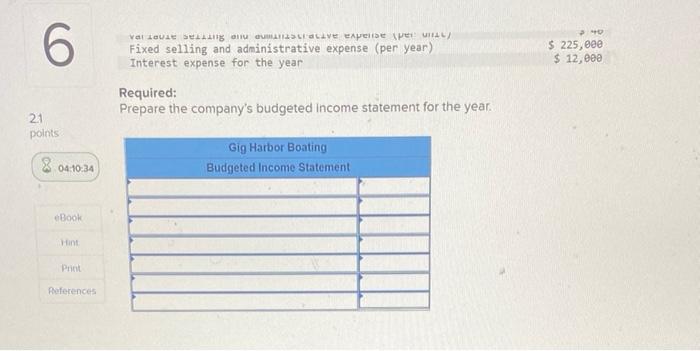

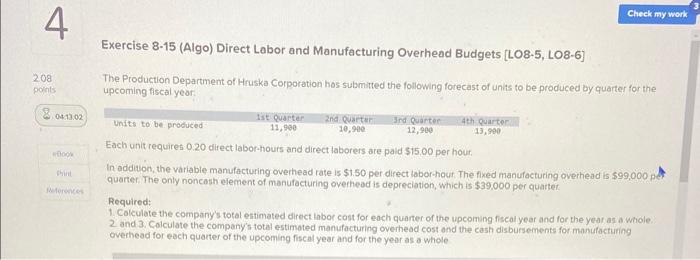

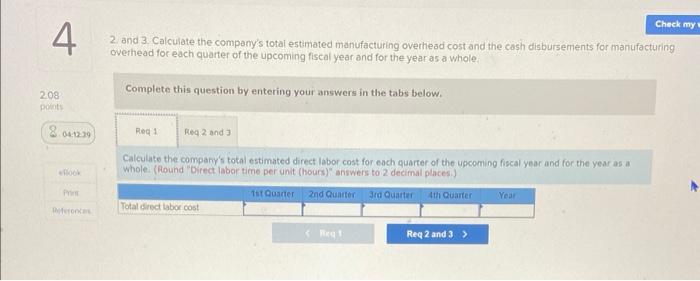

4 2.08 points 04.13.02 Book References Exercise 8-15 (Algo) Direct Labor and Manufacturing Overhead Budgets [LO8-5, LO8-6] The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year. 1st Quarter 11,900 2nd Quarter 10,900 3rd Quarter 12,900 Check my work 4th Quarter 13,990 Units to be produced Each unit requires 0.20 direct labor-hours and direct laborers are paid $15.00 per hour. In addition, the variable manufacturing overhead rate is $1.50 per direct labor-hour. The fixed manufacturing overhead is $99,000 pe quarter. The only noncash element of manufacturing overhead is depreciation, which is $39,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2 and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole 4 2.08 points 8.04.12.29 Print References 2 and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) 2nd Quarter 3rd Quarter 4th Quarter Total direct labor cost 1st Quarter Check my Year 4 2.08 points 04:12:27 eBook Pore References 2 and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quan the the upcoming fiscal year and for the year as a whole. 1st Quarter Total manufacturing overhead Cash disbursements for manufacturing overhead Check my w 4th Quarter Year 5 2.08 points 04.12.09 look Hint Print forences Exercise 8-7 (Algo) Cash Budget [LO8-8] Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: Total cash receipts Total cash disbursements 1st Quarter $ 200,000 $274,000 2nd Quarter $ 350,000 $ 244,000 3rd Quarter $ 230,000 $ 234,000 Check my work 4th Quarter $ 250,000 $ 254,000 The company's beginning cash balance for the upcoming fiscal year will be $24,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments and interest should be indicated by a minus sign.) 5 2.08 points 041101 ellook Print theferences Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excess (deficiency) of cash available over disbursements Financing Borrowings Repayments Interest Total financing Ending cash balance Garden Depot Cash Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Check m 6 21 points 04:10:45 villook Print Exercise 8-8 (Algo) Budgeted Income Statement [LO8-9) Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year Required: Prepare the company's budgeted income statement for the year. 480 $ 1,960 $1,358 $40 Check my work $ 225,000 $ 12,000 6 21 points 8 04:10:34 eBook Hint Print References VOLO SE ve experise (per u Fixed selling and administrative expense (per year) Interest expense for the year Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement 940 $ 225,000 $ 12,000

![Labor and Manufacturing Overhead Budgets [LO8-5, LO8-6] The Production Department of Hruska](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718cb61c8ee7_1776718cb6142bdc.jpg)