Question: if it could be done in excel that would be great Problem 3: Carolina Company is considering Projects S and L, whose cash flows the

if it could be done in excel that would be great

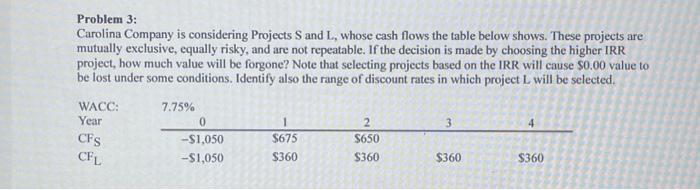

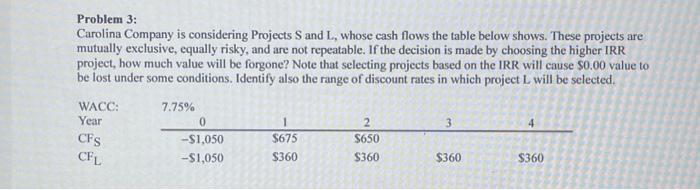

Problem 3: Carolina Company is considering Projects S and L, whose cash flows the table below shows. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the higher IRR project, how much value will be forgone? Note that selecting projects based on the IRR will cause $0.00 value to be lost under some conditions. Identify also the range of discount rates in which project L will be selected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock