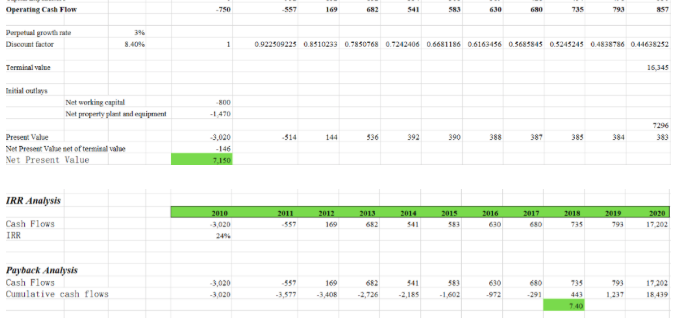

Question: if payback period does not consider the TVM, but we are given a discount rate and terminal value in the case, should we use operating

if payback period does not consider the TVM, but we are given a discount rate and terminal value in the case, should we use operating cash flow or present value? why should we consider it here?

Operating Cash Flow Perpetual growth rate Discount factor 1 0 .922509225 0.8510233 0.7850768 0.7242406 0.0681186 0.6163456 0.5685845 0.5245245 0.4838786 0.44638252 Terminal value 16,345 Talous Networking capital Net property a nd equip 1470 3,020 -514 1 44 336 392 390 388 387 383 384 383 Preve Value Net Preses Vahe set of termate Net Present Value 7150 IRR Analysis 2011 2012 2013 2014 2013 2010 3,020 583 630 680 793 Cash Flows TRR 17 202 Payback Analysis Cash Flows Cumulative cash flows 3.020 -3.020 -497 735 169 169 -3408 682 82 2,726 541 -2,185 583 1 602 630 972 680 291 793 1237 17202 18439

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts