Question: if possibke please include excel functions or steps. Thank you!! Chapter 4 Homework Problems 4-2. Berlin Corporation has $1,000 par value, 10-year bonds outstanding that

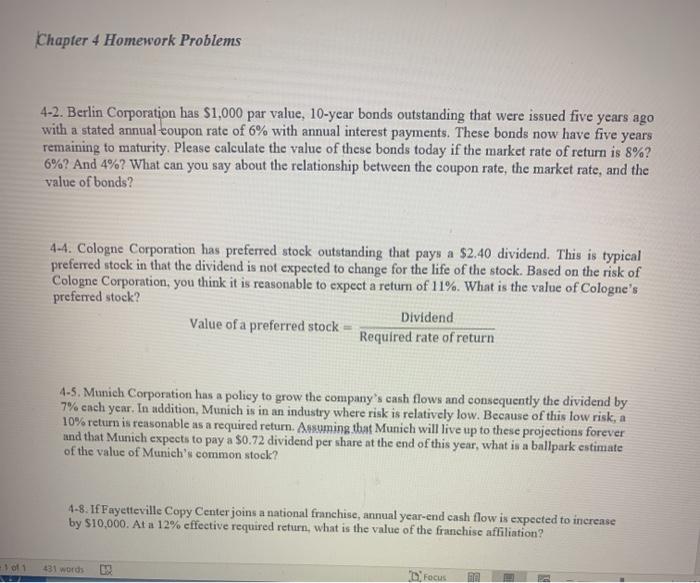

Chapter 4 Homework Problems 4-2. Berlin Corporation has $1,000 par value, 10-year bonds outstanding that were issued five years ago with a stated annual-coupon rate of 6% with annual interest payments. These bonds now have five years remaining to maturity. Please calculate the value of these bonds today if the market rate of return is 8%? 6%? And 4%? What can you say about the relationship between the coupon rate, the market rate, and the value of bonds? 4-4. Cologne Corporation has preferred stock outstanding that pays a $2,40 dividend. This is typical preferred stock in that the dividend is not expected to change for the life of the stock. Based on the risk of Cologne Corporation, you think it is reasonable to expect a return of 11%. What is the value of Cologne's preferred stock? Dividend Value of a preferred stock Required rate of return 4-5. Munich Corporation has a policy to grow the company's cash flows and consequently the dividend by 7% each year. In addition, Munich is in an industry where risk is relatively low. Because of this low risk, a 10% return is reasonable as a required return. Assuming that Munich will live up to these projections forever and that Munich expects to pay a $0.72 dividend per share at the end of this year, what is a ballpark estimate of the value of Munich's common stock? 4-8. If Fayetteville Copy Center joins a national franchise, annual year-end cash flow is expected to increase by $10,000. At a 12% effective required return, what is the value of the franchise affiliation? - 1 of 1 131 words Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts