Question: if possible answer questions 1-8 1. How is accounting data useful to investors? To creditors? 2. In what ways do you think information useful for

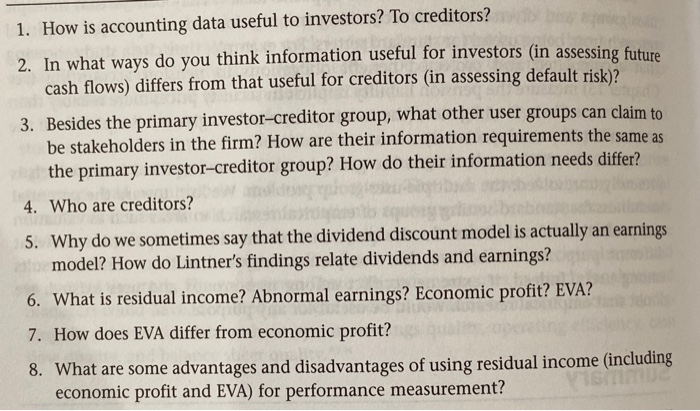

1. How is accounting data useful to investors? To creditors? 2. In what ways do you think information useful for investors in assessing future cash flows) differs from that useful for creditors (in assessing default risk)? 3. Besides the primary investor-creditor group, what other user groups can claim to be stakeholders in the firm? How are their information requirements the same as the primary investor-creditor group? How do their information needs differ? 4. Who are creditors? 5. Why do we sometimes say that the dividend discount model is actually an earnings model? How do Lintner's findings relate dividends and earnings? 6. What is residual income? Abnormal earnings? Economic profit? EVA? 7. How does EVA differ from economic profit? 8. What are some advantages and disadvantages of using residual income (including economic profit and EVA) for performance measurement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts