Question: if possible, answer with excel functions please. The Assignment Two years ago, your employer refurbished a previously unused area of its Austin factory. The cost

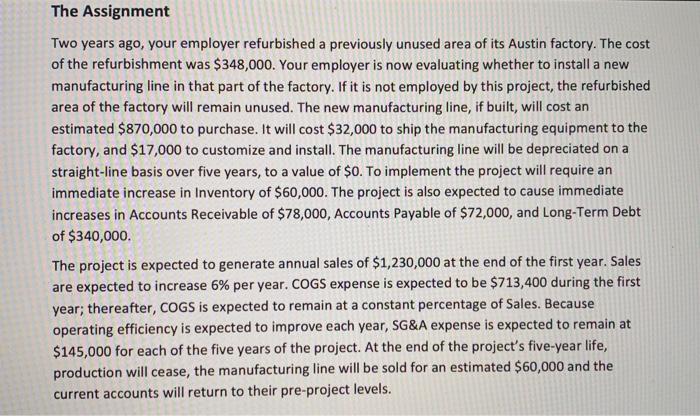

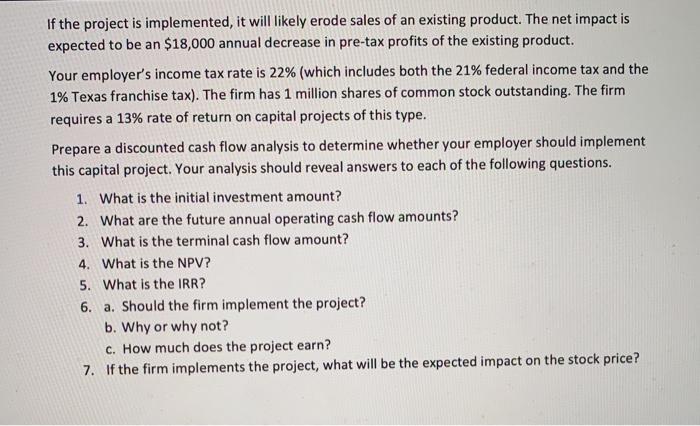

The Assignment Two years ago, your employer refurbished a previously unused area of its Austin factory. The cost of the refurbishment was $348,000. Your employer is now evaluating whether to install a new manufacturing line in that part of the factory. If it is not employed by this project, the refurbished area of the factory will remain unused. The new manufacturing line, if built, will cost an estimated $870,000 to purchase. It will cost $32,000 to ship the manufacturing equipment to the factory, and $17,000 to customize and install. The manufacturing line will be depreciated on a straight-line basis over five years, to a value of $o. To implement the project will require an immediate increase in Inventory of $60,000. The project is also expected to cause immediate increases in Accounts Receivable of $78,000, Accounts Payable of $72,000, and Long-Term Debt of $340,000. The project is expected to generate annual sales of $1,230,000 at the end of the first year. Sales are expected to increase 6% per year. COGS expense is expected to be $713,400 during the first year; thereafter, COGS is expected to remain at a constant percentage of Sales. Because operating efficiency is expected to improve each year, SG&A expense is expected to remain at $145,000 for each of the five years of the project. At the end of the project's five-year life, production will cease, the manufacturing line will be sold for an estimated $60,000 and the current accounts will return to their pre-project levels. If the project is implemented, it will likely erode sales of an existing product. The net impact is expected to be an $18,000 annual decrease in pre-tax profits of the existing product. Your employer's income tax rate is 22% (which includes both the 21% federal income tax and the 1% Texas franchise tax). The firm has 1 million shares of common stock outstanding. The firm requires a 13% rate of return on capital projects of this type. Prepare a discounted cash flow analysis to determine whether your employer should implement this capital project. Your analysis should reveal answers to each of the following questions. 1. What is the initial investment amount? 2. What are the future annual operating cash flow amounts? 3. What is the terminal cash flow amount? 4. What is the NPV? 5. What is the IRR? 6. a. Should the firm implement the project? b. Why or why not? C. How much does the project earn? 7. If the firm implements the project, what will be the expected impact on the stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts