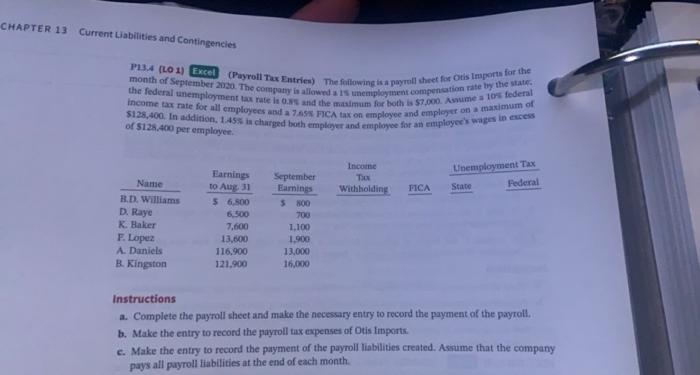

Question: if possible can you explain why you did what you did as well? month of September 2020. The company is allowed unemployment compensation rate by

month of September 2020. The company is allowed unemployment compensation rate by the state (Payroll Tax Entries) The following is payroll sheet for Otis Imports for the income tax rate for all employees and a 7.09 FICA tax on employee and employer on a maximum of the federal unemployment rates and the minimum for both $7.000. Asume 10 federal $128,400. In addition, 1.455 is charged both employer and employee for an employees wages in excess CHAPTER 13 Current Liabilities and Contingencies P13.4 (LO) Excel of $128.400 per employee Income Tos Withholding Unemployment Tax State Federal FICA Name B.D. Williams D. Raye K. Haker F. Lopez A. Daniels B. Kingston Earnings to Aug 31 56.500 6,500 7,600 13,000 116.900 121.900 September Earnings 5 800 700 1.100 1.900 13,000 16.000 Instructions a. Complete the payroll sheet and make the necessary entry to record the payment of the payroll b. Make the entry to record the payroll tax expenses of Otis Imports c. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month. UDC Excel Assignments Problem 13-4 25 points Jue January 21, 2021 at midnight 1. Should be prepared using Excel 2. Should incorporate any necessary formulas to calculate the correct solution 3. Should use proper formatting so that the solution is visually appealing Think a document you would prepare to present to your boss 4. Attach files here for grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts