Question: If possible, it would be best if there were formulas and work shown. The answers listed are correct so far, I am just unsure how

If possible, it would be best if there were formulas and work shown. The answers listed are correct so far, I am just unsure how they were found. I need the most help on the second part.

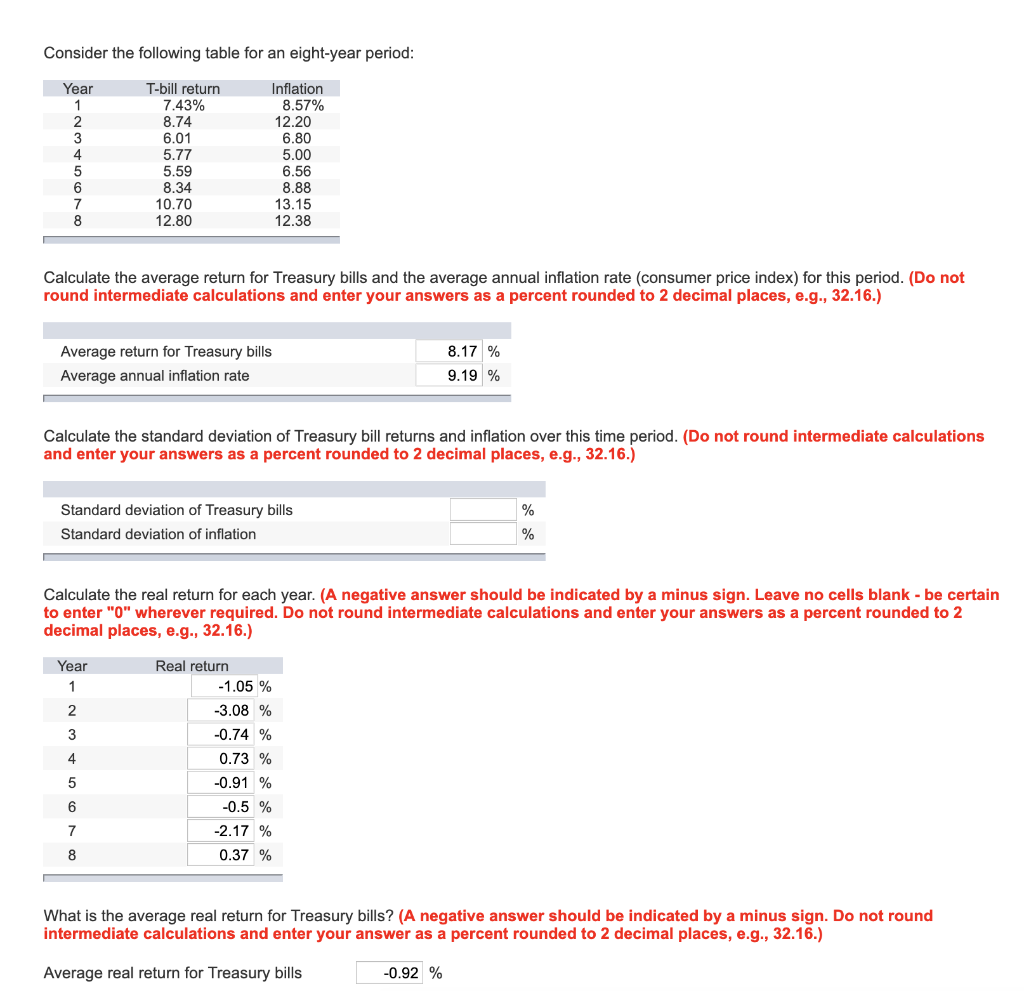

Consider the following table for an eight-year period: T-bill return 7.43% Year Inflation 8.57% 12.20 1 8.74 6.01 2 3 6.80 5.00 4 5.77 5 6 5.59 8.34 6.56 8.88 10.70 12,80 13.15 12.38 7 8 Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 8.17% Average return for Treasury bills 9.19% Average annual inflation rate Calculate the standard deviation of Treasury bill returns and inflation over this time period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation of Treasury bills Standard deviation of inflation % Calculate the real return for each year. (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not rotend intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Year Real return -1.05 % 1 2 -3.08 % -0.74% 3 0.73% 4 -0.91 % 5 -0.5 % 6 -2.17 % 7 8 0.37 % What is the average real return for Treasury bills? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Average real return for Treasury bills -0.92 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts