Question: If possible, please do in excel sheet and show the workings too, thank you :) Elvis Inc. is planning to establish a subsidiary in Australia

If possible, please do in excel sheet and show the workings too, thank you :)

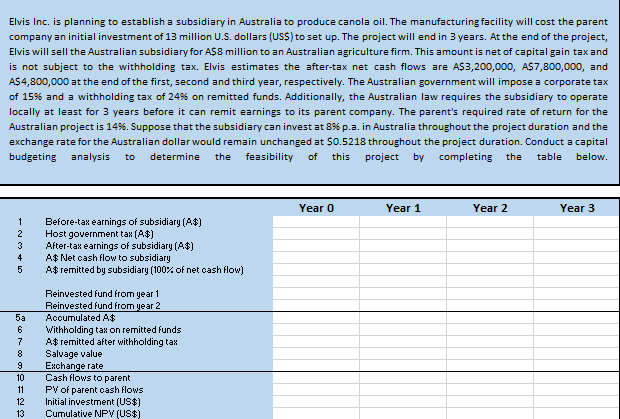

Elvis Inc. is planning to establish a subsidiary in Australia to produce canola oil. The manufacturing facility will cost the parent company an initial investment of 13 million U.S. dollars (US$) to set up. The project will end in 3 years. At the end of the project, Elvis will sell the Australian subsidiary for $8 million to an Australian agriculture firm. This amount is net of capital gain tax and is not subject to the withholding tax. Elvis estimates the after-tax net cash flows are A$3,200,000, A$7,800,000, and A$4,800,000 at the end of the first, second and third year, respectively. The Australian government will impose a corporate tax of 15% and a withholding tax of 24% on remitted funds. Additionally, the Australian law requires the subsidiary to operate locally at least for 3 years before it can remit earnings to its parent company. The parent's required rate of return for the Australian project is 14%. Suppose that the subsidiary can invest at 8% p.a. in Australia throughout the project duration and the exchange rate for the Australian dollar would remain unchanged at $0.5218 throughout the project duration. Conduct a capital budgeting analysis determine the feasibility of this project by completing the table below. to Year 0 Year 1 Year 2 Year 3 1 2 3 4 5 Before-tax earnings of subsidiary (A$) Host government tax (A$) After-tax earnings of subsidiary (A$) A$ Net cash flow to subsidiary A$remitted by subsidiary (100% of net cash flow) 5a 6 7 Reinvested fund from year 1 Reinvested fund from year 2 Accumulated A$ Withholding tax on remitted funds A$remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flows Initial investment (US$) Cumulative NPV (US$) 9 10 11 12 13 Elvis Inc. is planning to establish a subsidiary in Australia to produce canola oil. The manufacturing facility will cost the parent company an initial investment of 13 million U.S. dollars (US$) to set up. The project will end in 3 years. At the end of the project, Elvis will sell the Australian subsidiary for $8 million to an Australian agriculture firm. This amount is net of capital gain tax and is not subject to the withholding tax. Elvis estimates the after-tax net cash flows are A$3,200,000, A$7,800,000, and A$4,800,000 at the end of the first, second and third year, respectively. The Australian government will impose a corporate tax of 15% and a withholding tax of 24% on remitted funds. Additionally, the Australian law requires the subsidiary to operate locally at least for 3 years before it can remit earnings to its parent company. The parent's required rate of return for the Australian project is 14%. Suppose that the subsidiary can invest at 8% p.a. in Australia throughout the project duration and the exchange rate for the Australian dollar would remain unchanged at $0.5218 throughout the project duration. Conduct a capital budgeting analysis determine the feasibility of this project by completing the table below. to Year 0 Year 1 Year 2 Year 3 1 2 3 4 5 Before-tax earnings of subsidiary (A$) Host government tax (A$) After-tax earnings of subsidiary (A$) A$ Net cash flow to subsidiary A$remitted by subsidiary (100% of net cash flow) 5a 6 7 Reinvested fund from year 1 Reinvested fund from year 2 Accumulated A$ Withholding tax on remitted funds A$remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flows Initial investment (US$) Cumulative NPV (US$) 9 10 11 12 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts