Question: If possible, please try to answer in excel 1. The JJ. Binks Company is an all equity firm. It expects perpetual earnings before interest and

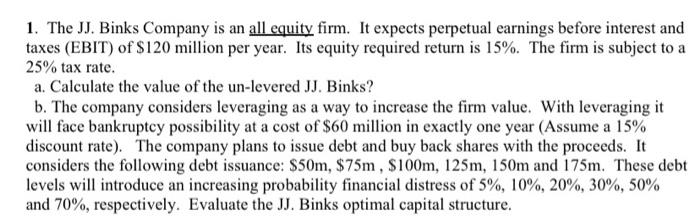

1. The JJ. Binks Company is an all equity firm. It expects perpetual earnings before interest and taxes (EBIT) of $120 million per year. Its equity required return is 15%. The firm is subject to a 25% tax rate. a. Calculate the value of the un-levered JJ. Binks? b. The company considers leveraging as a way to increase the firm value. With leveraging it will face bankruptcy possibility at a cost of $60 million in exactly one year (Assume a 15% discount rate). The company plans to issue debt and buy back shares with the proceeds. It considers the following debt issuance: $50m, $75m, $100m, 125m, 150m and 175m. These debt levels will introduce an increasing probability financial distress of 5%, 10%, 20%, 30%, 50% and 70%, respectively. Evaluate the JJ. Binks optimal capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts