Question: If question appears hard to read/blury just zoom in Which one of the following bonds would you select if you thought market interest rates were

If question appears hard to read/blury just zoom in

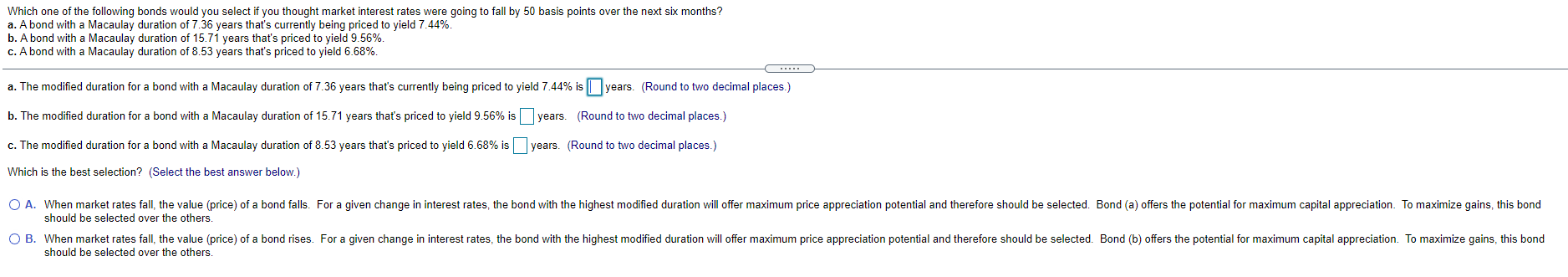

Which one of the following bonds would you select if you thought market interest rates were going to fall by 50 basis points over the next six months? a. A bond with a Macaulay duration of 7.36 years that's currently being priced to yield 7.44% b. A bond with a Macaulay duration of 15.71 years that's priced to yield 9.56%. c. A bond with a Macaulay duration of 8.53 years that's priced to yield 6.68%. a. The modified duration for a bond with a Macaulay duration of 7.36 years that's currently being priced to yield 7.44% is years. (Round to two decimal places.) b. The modified duration for a bond with a Macaulay duration of 15.71 years that's priced to yield 9.56% is years. (Round to two decimal places.) c. The modified duration for a bond with a Macaulay duration of 8.53 years that's priced to yield 6.68% is years. (Round to two decimal places.) Which is the best selection? (Select the best answer below.) O A. When market rates fall, the value (price) of a bond falls. For a given change in interest rates, the bond with the highest modified duration will offer maximum price appreciation potential and therefore should be selected. Bond (a) offers the potential for maximum capital appreciation. To maximize gains, this bond should be selected over the others. OB. When market rates fall, the value (price) of a bond rises. For a given change in interest rates, the bond with the highest modified duration will offer maximum price appreciation potential and therefore should be selected. Bond (b) offers the potential for maximum capital appreciation. To maximize gains, this bond should be selected over the others

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts