Question: If Quick Company used Double Declining Balance (DDB) depreciation method instead of straight-line, calculate the following: Depreciation expense each year Accumulated depreciation each year Net

- If Quick Company used Double Declining Balance (DDB) depreciation method instead of straight-line, calculate the following:

- Depreciation expense each year

- Accumulated depreciation each year

- Net book value each year

- Impairment loss (if any) at the end of year 4

- Comparing the impairment loss in d) with the impairment loss we calculated in class under the straight-line method, discuss the implication.

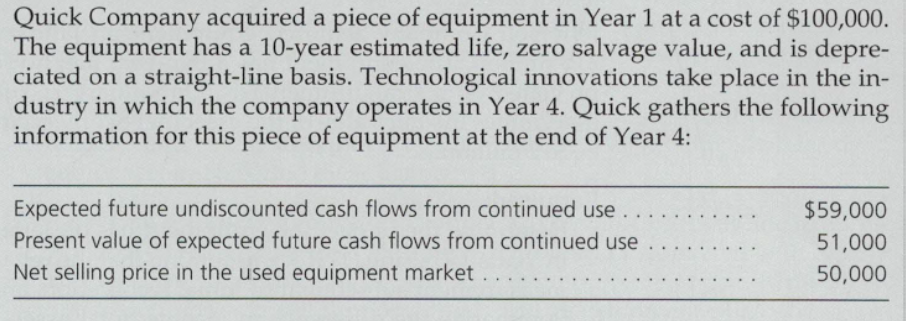

Quick Company acquired a piece of equipment in Year 1 at a cost of $100,000. The equipment has a 10-year estimated life, zero salvage value, and is depre- ciated on a straight-line basis. Technological innovations take place in the in- dustry in which the company operates in Year 4. Quick gathers the following information for this piece of equipment at the end of Year 4: Expected future undiscounted cash flows from continued use ... Present value of expected future cash flows from continued use Net selling price in the used equipment market. $59,000 51,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts