Question: If screenshot is not clear, please Google the Form Chapter 4 TRP 4-1 Assume the taxpayer does not wish to contribute to the Presidential Election

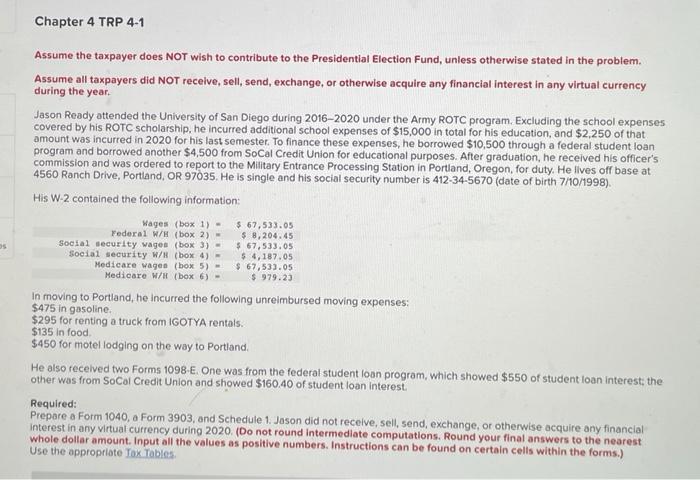

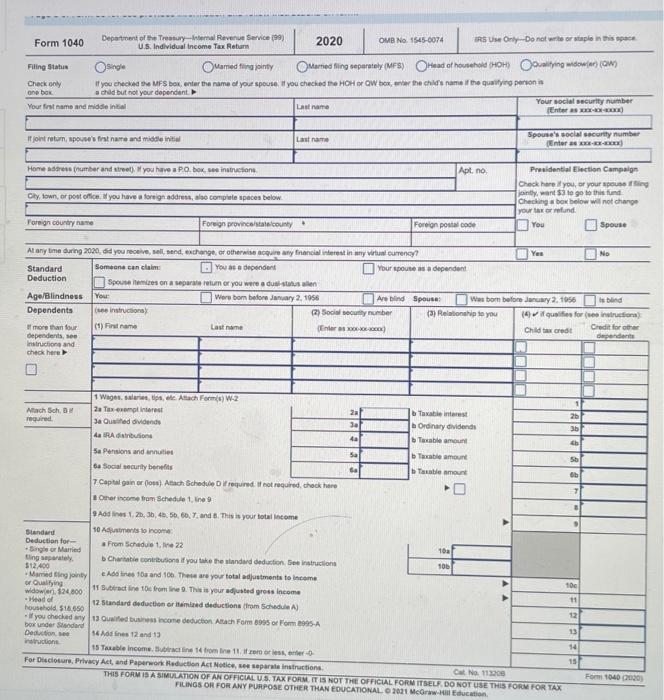

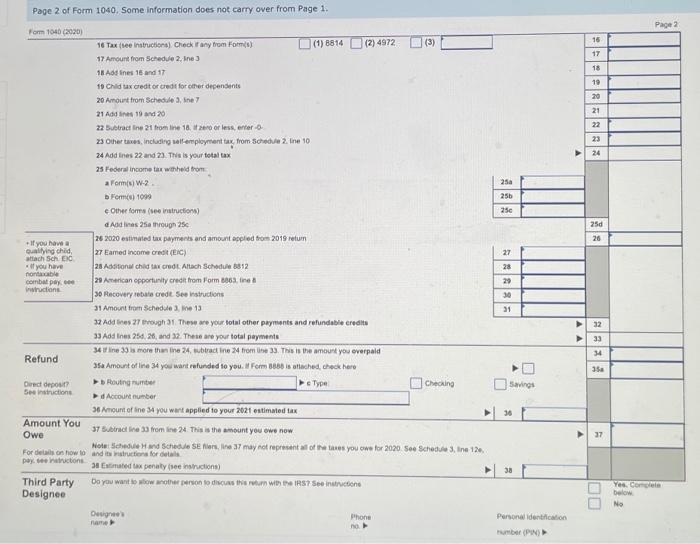

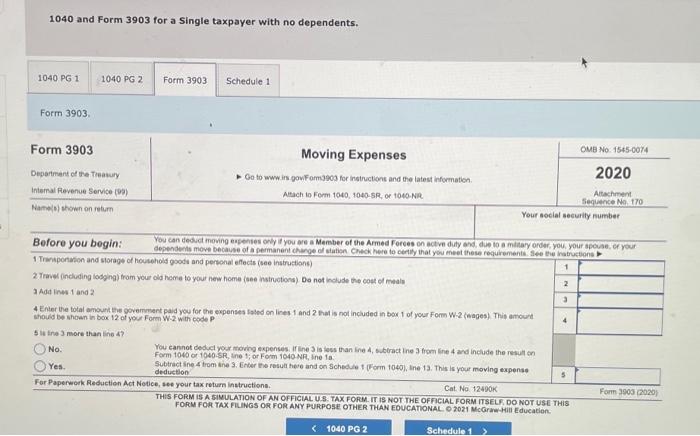

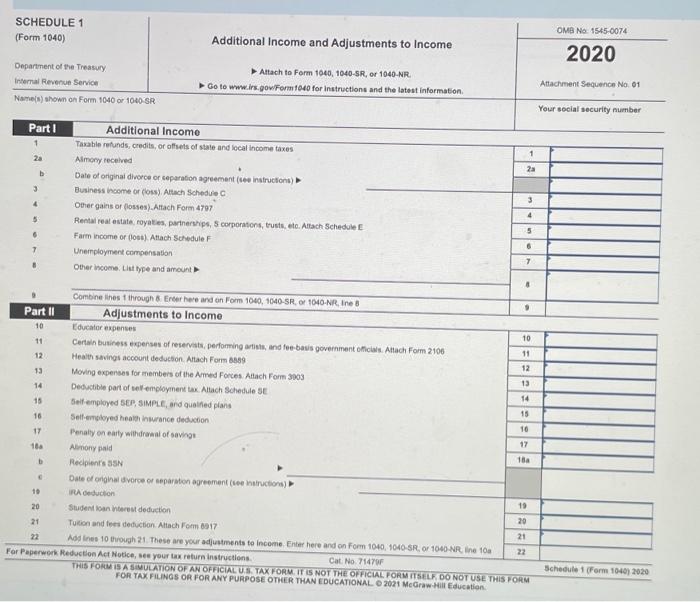

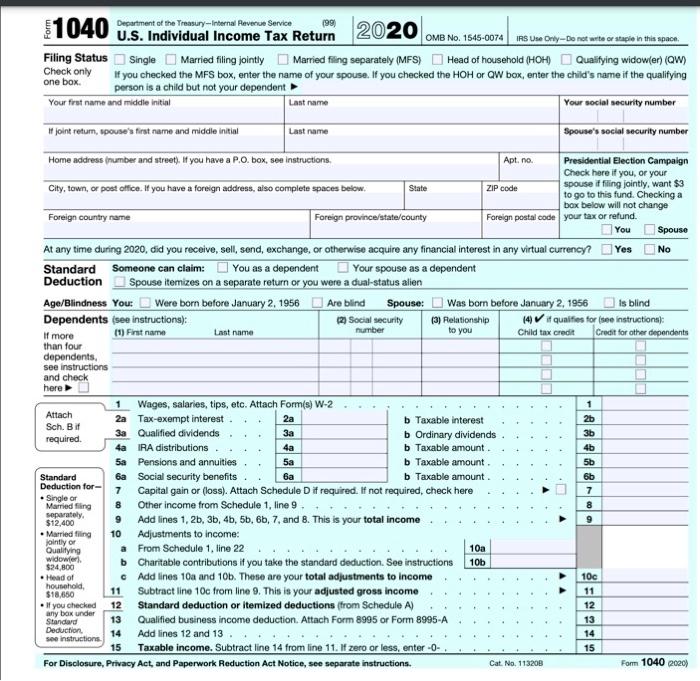

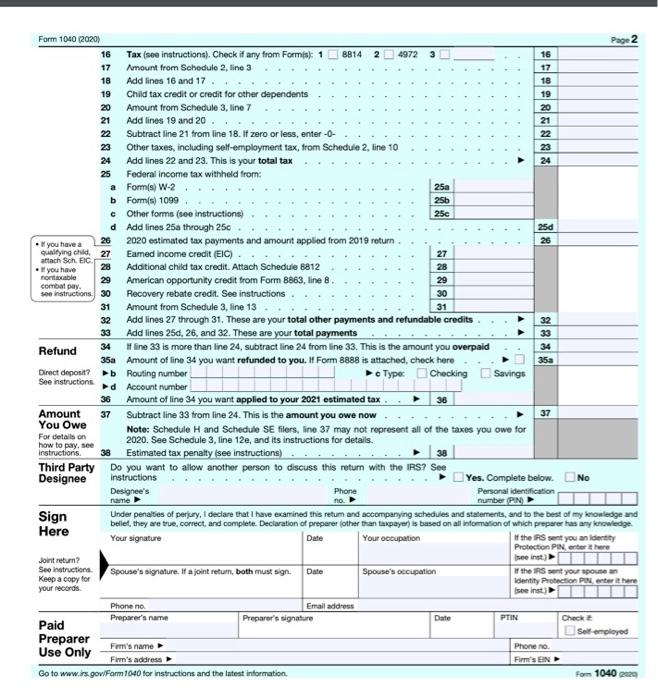

Chapter 4 TRP 4-1 Assume the taxpayer does not wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Jason Ready attended the University of San Diego during 2016-2020 under the Army ROTC program. Excluding the school expenses covered by his ROTC scholarship, he incurred additional school expenses of $15,000 in total for his education, and $2.250 of that amount was incurred in 2020 for his last semester. To finance these expenses, he borrowed $10,500 through a federal student loan program and borrowed another $4,500 from SoCal Credit Union for educational purposes. After graduation, he received his officer's commission and was ordered to report to the Military Entrance Processing Station in Portland, Oregon, for duty. He lives off base at 4560 Ranch Drive, Portland, OR 97035. He is single and his social security number is 412-34-5670 (date of birth 7/10/1998). His W-2 contained the following information: Wages (box 1) - Federal W/H (box 2) - social security wages (box 3) Social security W/B (box 4) - Medicare wages (box 5) - Medicare W/H (box 6) - $ 67,533.05 $ 8,204.45 $ 67,533.05 54,187.05 $ 67,533.05 $ 979.23 In moving to Portland, he incurred the following unreimbursed moving expenses: $475 in gasoline $295 for renting a truck from IGOTYA rentals. $135 in food $450 for motel lodging on the way to Portland, He also received two Forms 1098-E. One was from the federal student loan program, which showed $550 of student loan interest, the other was from SoCal Credit Union and showed $160.40 of student loan interest Required: Prepare a Form 1040, a Form 3903, and Schedule 1. Jason did not receive, sell, send, exchange, or otherwise acquire any financial Interest in any virtual currency during 2020. (Do not round Intermediate computations. Round your final answers to the nearest whole dollar amount. Input all the values as positive numbers. Instructions can be found on certain cells within the forms.) Use the appropriate Tox Tables Form 1040 Department of the Treasury--Internal Revenue Service (99) 2020 OMB No 1545-0074 U.S. Individual Income Tax Return IRSUM Only-Do not write or staple in this space Filing Status Single wamed fling point Marned fing separately (MFS) Head of household (HOHOlying widow (W Check only if you checked MFS box, enter the name of your spouse you checked the HOH O QW bore the child's name if the quality person is one box a chid but not your dependent Your first name and middel Your social security number Last name Enter Intratum, spouse's fint name and middle initial Last name Spouse's social security number Enters -- Home stress number and street) you have a PO box instructions |Apt, no Cly, town, or post office you have a foreign address, also complete spaces below Presidential Election Campaign Check here you, or your spouse jointly want to go to this und Checking a box below will not change your tax or und You Spouse Foreign country and Foreign provincestcounty Foreign postal code At any time during 2020, did you receive, sell, and exchange or otherwise are any financial interest in any virtual currency Yes NO Standard Someone can cm You as a dependent Your spout a dependent Deduction Spousers on a separate return or you were a dual statusan Age/Blindness You Were bom before January 2, 1956 Are blind Spouse Was bombefore January 2, 1056 bind Dependents ( Instructions (2) Sociolott umber (3) Relationship to you (4 il quales for instruction more than four (1) Frame Last name Ener Child tax credit Credit for other dependents, see dependente Instruction and check here 1 Wages, sc. Asach Form) W-2 Attach Sch. 2a Tax complinterest 2 Taxable interest 25 required 3a Quad vidende 30 Ordinary dividends ASRA drone 4 Table amount ch 5a Pensions and annuities Sa Table amount 50 6a Social security benefits Ga blement Ob 7 Capital gain or (on). Attach Schedule Drequired if not required. Check here o 7 Other income from Schedule 1. line 9 9 Addes 1. 2. 3. 4. 5. 6. 7 and 8. This is your total income Standard 10 Adjustments to come Deduction for From Schedule 1. in 22 - Sangle or Married 10a Singapore Charitable contribution if you take the standard deduction Sestruction 100 $12.400 Marding Addines 10s and 106. These are your total adjustments to Income 100 or Quality widown 124800 11 Subtractine 10 from in. This is your adjusted gross income 11 ad of 12 Standard deduction or med deductions from Schedule A) household 518.650 12 - If you checked my 13 Qualified business income deduction Attach Form 6905 or om 1005A box under Standard 13 Deduction 54 Addins 12 and 13 inne 14 15 Taxable income Subcine com line 11. forsenter 15 For Disclosure Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat No. 11308 THIS FORM IS A SIMULATION OF AN OFFICIAL US. TAX FORM IT IS NOT THE OFFICIAL FORMISELE DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 Merwe Education For 10400000 Page 2 of Form 1040. Some information does not carry over from Page 1 Page 2 16 17 18 19 20 21 22 23 24 25a 256 250 250 26 27 Form 1040 (20301 16 Tax free instructions) Check it any from Form) (1) 8814 (2) 4972 (3) 17 Amount from Schedule 2. Ine 3 18. Add Ines 16 and 17 19 Chid tax creditor credit for other dependents 20 Amount from Schedule 3, sine 21 Addnes 19 and 20 22 Subtractine 21 from the 1.220 or less, efter 23 Other taxes, including well-employment tax from Schedule 2. ine 10 24 Add tres 22 and 23. The is your total tax 25 Federal income the whold from a FormW-2 For 100 Other forms (se instruction) Aadines 25 through 25 26 2020 estrated tax payments and amount applied from 2019 retum + If you have a Qualifying child 27 Eamed Income credit (EC) attach Sched . if you have 28 Additional ched tax cred Altach Schedule 6812 notable combat pay 29 American opportunity credit from Form 606, in wructions 30 Recovery rebate credt Seestructions 31 Amount from Schedule 3. Me 13 32 Add fines 27 h 31 These are your total other payments and refundable credits 33 Add Ines 250, 26, and 32. These are your total payments 34 in 39 s more than in 24 Subtractine from the 3. This is the amount you overald Refund 3a Amount of line 34 you want refunded to you. It Form 3888 is attached, check here Derect deposit Routingut e Type Checking Sections Account number 36 Amount of ine you want applied to your 2021 estimated tax Amount You 37 stractie 33 Tromie 24. This is the amount you owe now Owe Note: ScreeHand schedule Seferine 37 may not representat ofertes you cw for 2020 Soe Schedule 3. ine 12 For details on how to and its structions for details paytructions 38 Estimated tax penaly seestructions Third Party Do you want to wow others to this worn with RS7 Se inicione Designee 28 29 30 31 32 33 14 35 savings 37 38 00 Yes Corel below No Design name Phone no Personal identification umber (PN) 1040 and Form 3903 for a single taxpayer with no dependents. 1040 PG 1 1040 PG 2 Form 3903 Schedule 1 Form 3903 Form 3903 Department of the Treasury Internal Revenue Service (90) Name/shown on retum Moving Expenses o to www.ingowFom300 for instructions and the latest information Altach to Form 1040 1040-SR, or to NR OMB No 1545-0074 2020 Attachment Sequence No. 170 Your social security number 2 3 Before you begin: You can de moving ergenses only you are a Member of the Armed Forces on active duty and due to a mlitary order, you, your spouse of your dependents move because of a permanent change of station Check here to cortly that you meet these requirements. See the natructions 1 portation and storage of household goods and personal effects (see instructions) 2. Yet including lodging) from your old home to your new home (se natruction) Do not include the cost of me Addins 1 and 2 4 Enter the total amount the government pard you for the expenses Sted on line 1 and 2 that is not included in box 1 of your Form W.2 (wagen) This amount should be shown in box 12 of your Form W2 with code 5 is in more than line 47 No. You cannot deduct your moving expenses lineis fess than in 4 subtractine from line 4 and include the result on Form 1040 of 1040-SR. In 1; or Form 1040 NA, Ineta Yes Subtract in 4 trom the 3. Enter the retut here and on schedule (Form 1080), Ine 13. This is your moving expense deduction For Paperwork Reduction Act Notice, see your tax return instructions. Cat No 12400K Form 3003 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL US. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL O 2021 McGraw-Hill Education 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts