Question: If some one please could help me with this problem .I need to know how to properly posted journal entry.Thanks in Advance D Marching Company

If some one please could help me with this problem .I need to know how to properly posted journal entry.Thanks in Advance D

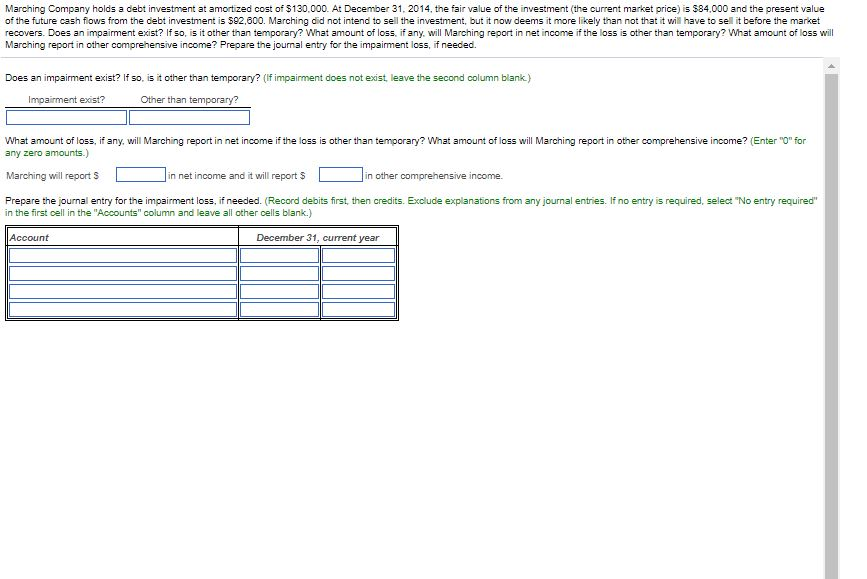

Marching Company holds a debt investment at amortized cost of $130,000. At December 31, 2014, the fair value of the investment (the current market price) is $84,000 and the present value of the future cash fiows from the debt investment is $92,600. Marching did not intend to sell the investment, but it now deems it more likely than not that it ill have to sell it before the market recovers. Does an impairment exist? If so, is it other than temporary? What amount of loss, if any. will Marching report in net income if the loss is other than temporary? What amount of loss wil Marching report in other comprehensive income? Prepare the journal entry for the impairment loss, if needed. Does an impairment exist? If so, is it other than temporary? (If impairment does not exist, leave the second column blank.) Imoairment exist? Other than temporary? What amount of loss, if any, will Marching report in net income if the loss is other than temporary? What amount of loss will Marching report in other comprehensive income? (Enter "0" for any zero amounts.) Marching will report s in net income and it will report $ in other comprehensive income Prepare the journal entry for the impairment loss, if needed. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required, select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Account December 31, current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts