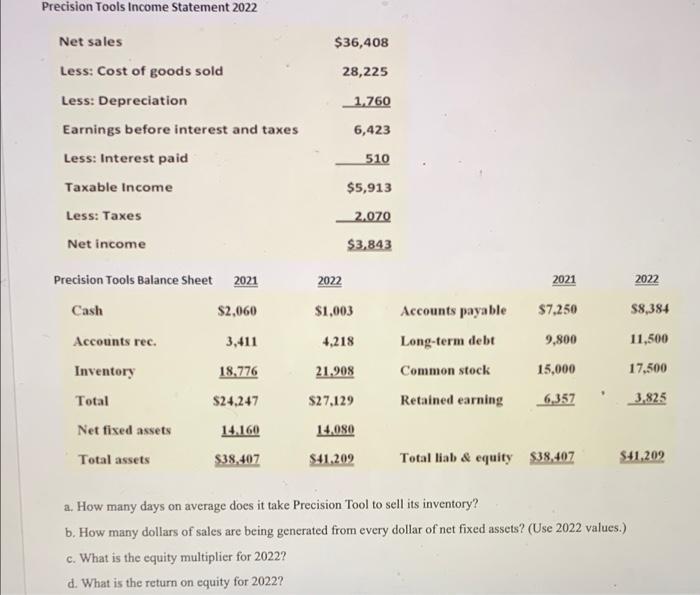

Question: if someone can help i would appreciate it! Precision Tools Income Statement 2022 $36,408 28,225 1.760 6,423 Net sales Less: Cost of goods sold Less:

Precision Tools Income Statement 2022 $36,408 28,225 1.760 6,423 Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable income Less: Taxes Net income 510 $5,913 2.070 $3,843 2021 2022 2021 2022 Precision Tools Balance Sheet Cash $2,060 $1,003 58,384 $7.250 9,800 Accounts rec. 3,411 Accounts payable Long-term debt Common stock 4,218 21.908 11,500 Inventory 18,776 15,000 17,500 Total $27.129 Retained earning 6,357 3.825 $24,247 14.160 $38,407 Net fixed assets Total assets 14,080 $41.202 Total liab & equity $38,407 $41,209 a. How many days on average does it take Precision Tool to sell its inventory? b. How many dollars of sales are being generated from every dollar of net fixed assets? (Use 2022 values.) c. What is the equity multiplier for 2022? d. What is the return on equity for 20222

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts