Question: If someone can help me with the final four problems in will upvote 3 Electric Utilities stock will pay an annual dividend of $12 per

If someone can help me with the final four problems in will upvote

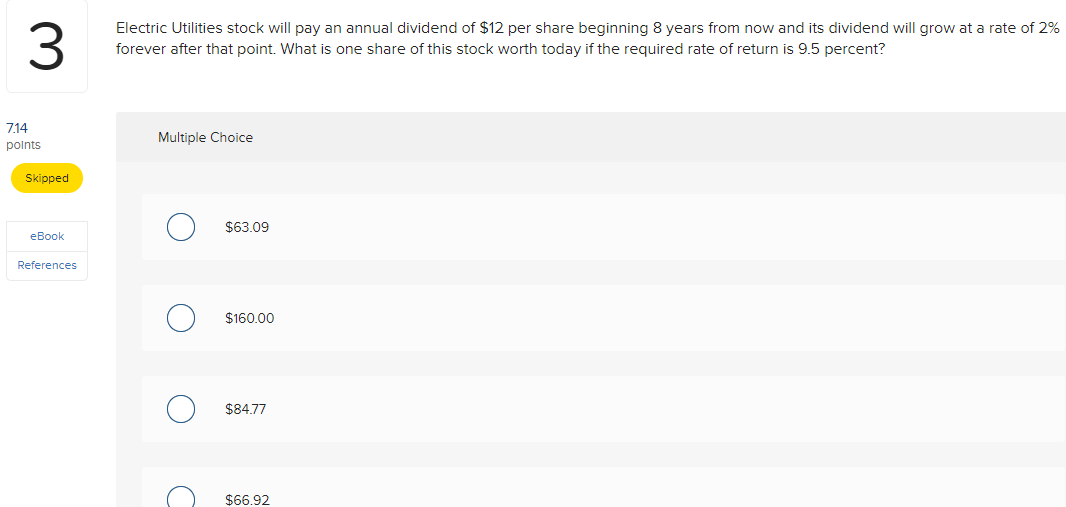

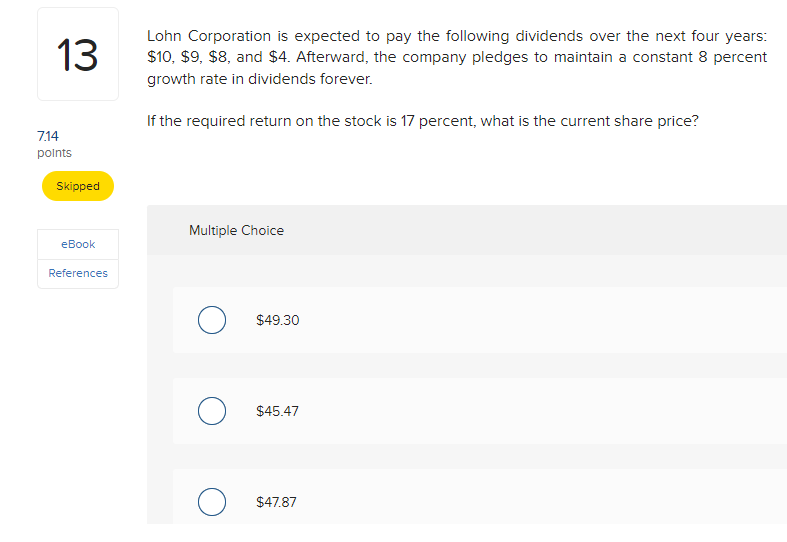

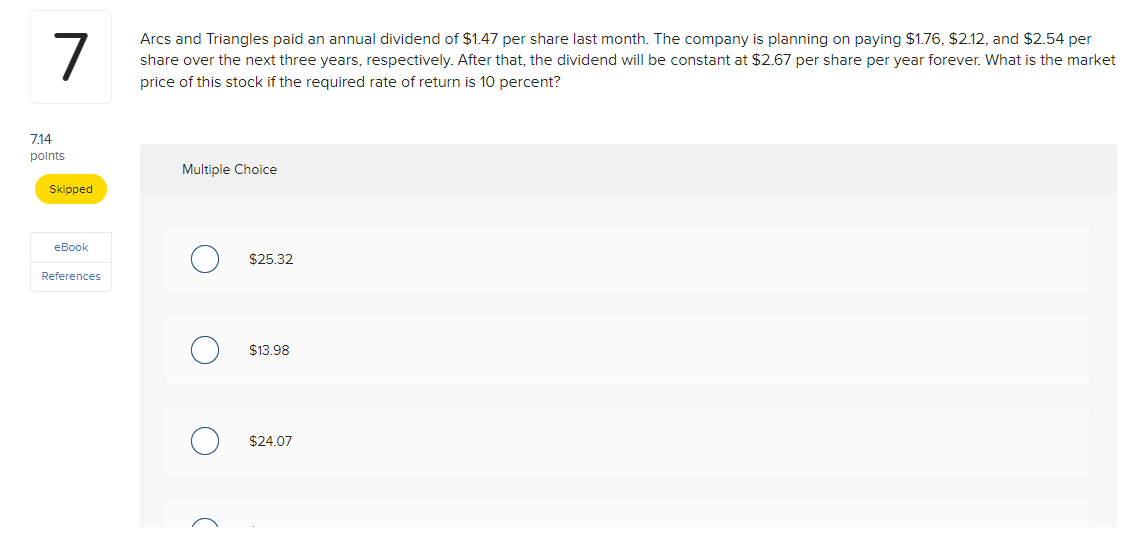

3 Electric Utilities stock will pay an annual dividend of $12 per share beginning 8 years from now and its dividend will grow at a rate of 2% forever after that point. What is one share of this stock worth today if the required rate of return is 9.5 percent? 7.14 points Multiple Choice Skipped $63.09 eBook References $160.00 $84.77 n $66.92 10 Sew 'N More just paid an annual dividend of $1.42 per share. The firm plans to grow annual dividends at a rate of 15% per year for four years. After that time, dividends will grow at a constant rate of 3% per year. What is this stock worth today at a discount rate of 11.7 percent? 7.14 points Multiple Choice Skipped eBook $13.30 References O $25.01 O $22.39 n 13 Lohn Corporation is expected to pay the following dividends over the next four years: $10, $9, $8, and $4. Afterward, the company pledges to maintain a constant 8 percent growth rate in dividends forever. If the required return on the stock is 17 percent, what is the current share price? 7.14 points Skipped Multiple Choice eBook References $49.30 $45.47 O $47.87 7 Arcs and Triangles paid an annual dividend of $1.47 per share last month. The company is planning on paying $1.76, $2.12, and $2.54 per share over the next three years, respectively. After that, the dividend will be constant at $2.67 per share per year forever. What is the market price of this stock if the required rate of return is 10 percent? 714 points Multiple Choice Skipped eBook $25.32 References O $13.98 O $24.07 (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts