Question: If someone could answer A,B,C,D I would appreciate it. Thanks! 8. Suppose you have a company in Scotland that generates free cash flows at 100,

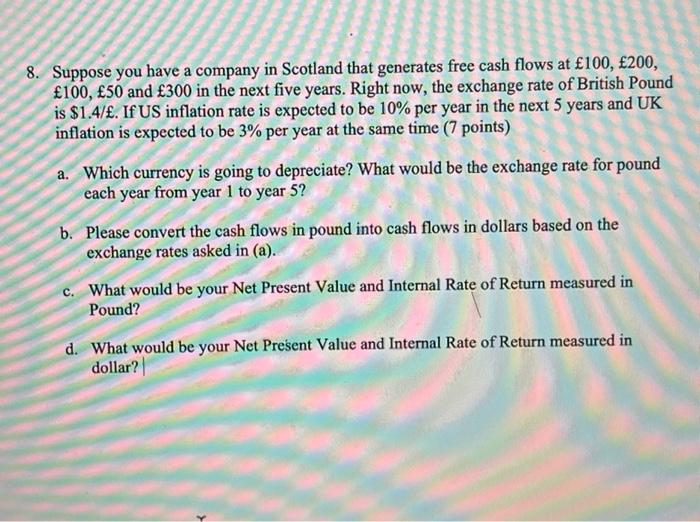

8. Suppose you have a company in Scotland that generates free cash flows at 100, 200, 100, 50 and 300 in the next five years. Right now, the exchange rate of British Pound is $1.4/. If US inflation rate is expected to be 10% per year in the next 5 years and UK inflation is expected to be 3% per year at the same time (7 points) a. Which currency is going to depreciate? What would be the exchange rate for pound each year from year 1 to year 5? b. Please convert the cash flows in pound into cash flows in dollars based on the exchange rates asked in (a). What would be your Net Present Value and Internal Rate of Return measured in Pound? d. What would be your Net Present Value and Internal Rate of Return measured in dollar? C. 8. Suppose you have a company in Scotland that generates free cash flows at 100, 200, 100, 50 and 300 in the next five years. Right now, the exchange rate of British Pound is $1.4/. If US inflation rate is expected to be 10% per year in the next 5 years and UK inflation is expected to be 3% per year at the same time (7 points) a. Which currency is going to depreciate? What would be the exchange rate for pound each year from year 1 to year 5? b. Please convert the cash flows in pound into cash flows in dollars based on the exchange rates asked in (a). What would be your Net Present Value and Internal Rate of Return measured in Pound? d. What would be your Net Present Value and Internal Rate of Return measured in dollar? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts