Question: If someone could answer these questions that would be amazing. I apologize for posting multiple questions. University Car Wash purchased new soap dispensing equipment that

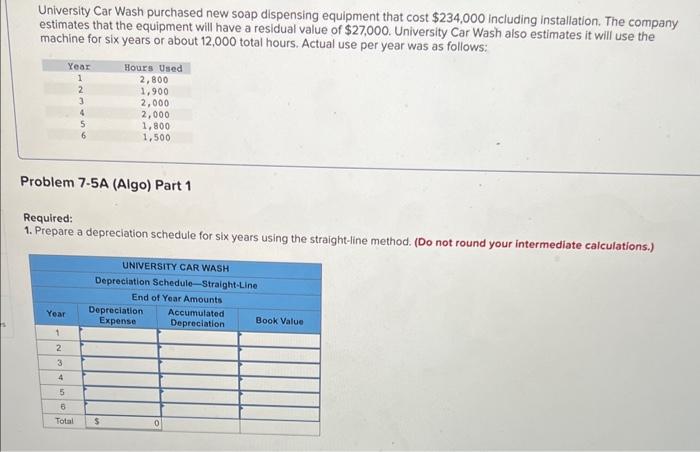

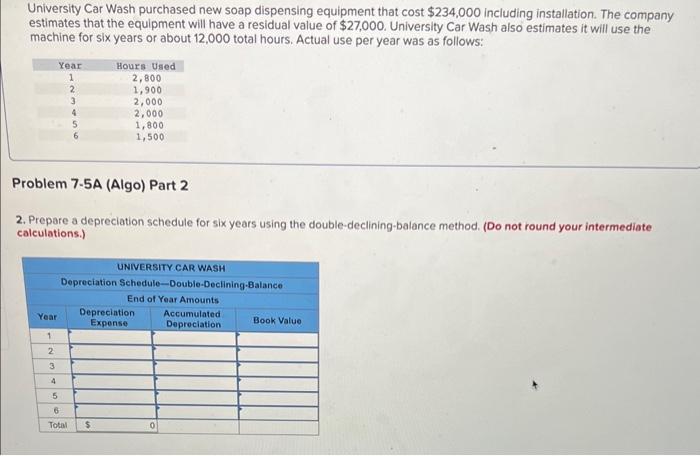

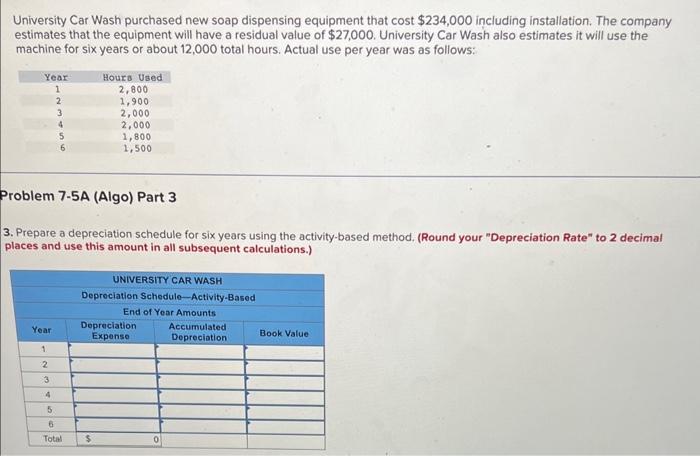

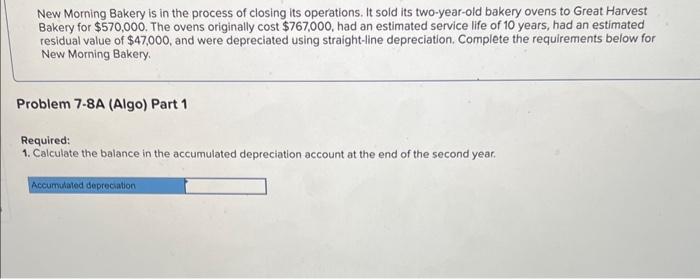

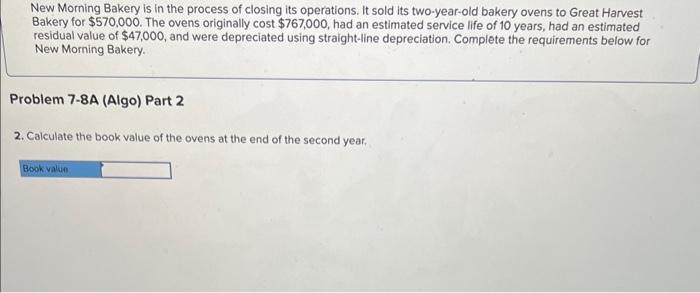

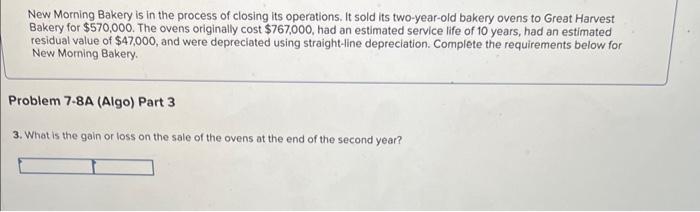

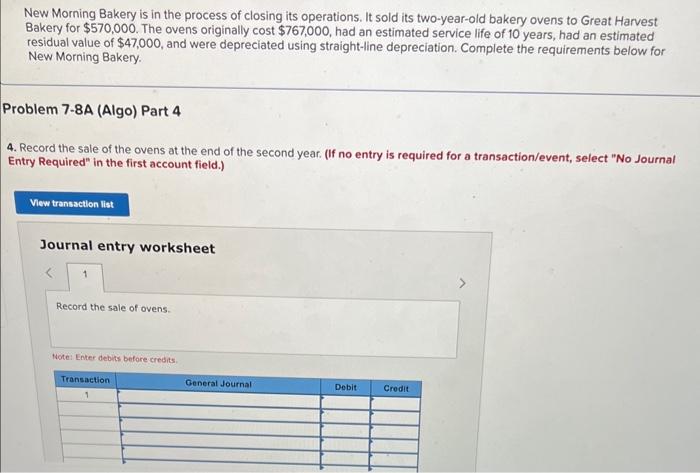

University Car Wash purchased new soap dispensing equipment that cost $234,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Problem 7-5A (Algo) Part 1 Required: 1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) University Car Wash purchased new soap dispensing equipment that cost $234,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Problem 7-5A (Algo) Part 2 2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.) University Car Wash purchased new soap dispensing equipment that cost $234,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Problem 7-5A (Algo) Part 3 3. Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.) New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $570,000. The ovens originally cost $767,000, had an estimated service life of 10 years, had an estimated residual value of $47,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 1 Required: 1. Calculate the balance in the accumulated depreciation account at the end of the second year. New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $570,000. The ovens originally cost $767,000, had an estimated service life of 10 years, had an estimated residual value of $47,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 2 2. Calculate the book value of the ovens at the end of the second year. New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $570,000. The ovens originally cost $767,000, had an estimated service life of 10 years, had an estimated residual value of $47,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 3 3. What is the gain or loss on the sale of the ovens at the end of the second year? New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $570,000. The ovens originally cost $767,000, had an estimated service life of 10 years, had an estimated residual value of $47,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. roblem 7-8A (Algo) Part 4 Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal intry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts