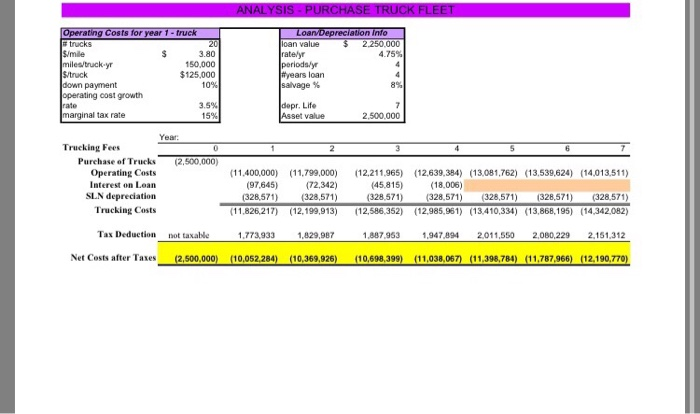

Question: If someone could help me with excel formulas to get the interest on loan, SLN depreciation, trucking cost, tax deduction and net costs after taxes

2,250,000 4.75% value 3.80 150,000 $125,000 10% ratelyr Svtruck loan payment 8% cost growth 3.5% Life tax rate 2,500,000 Trucking Fees Purchase of Trucks 2,500,000) Operating Costs Interest on Loan SLN depreciation Trucking Costs 11,400,000) 11,799,000) (12,211,965) (12,639,384) 13,081,762) 13,539,624) 14,013,511) 328,571) (328,571) 11,826,217) (12,199,913) 12,586,352) 12,985,9) (13,410,334) (13,868,195) (14,342082) 1,947,894 2011,50 2,080,229 2,151,312 (97,645) (72,342) 328,571)328,571) 45,815) 18,006) (328,571)(328,571) (328,571 Tax Deduction not taxalble 773,933 1829,987 887.953 Net Costs after Taxes 500 10.052.284 10,369,926 (10,698,39 11,038,067 1,398,784) (11,787,966) (12,190

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts