Question: If someone could please break this question down for me , that would be greatly appreciated. I have seen the same problem posted numerous times

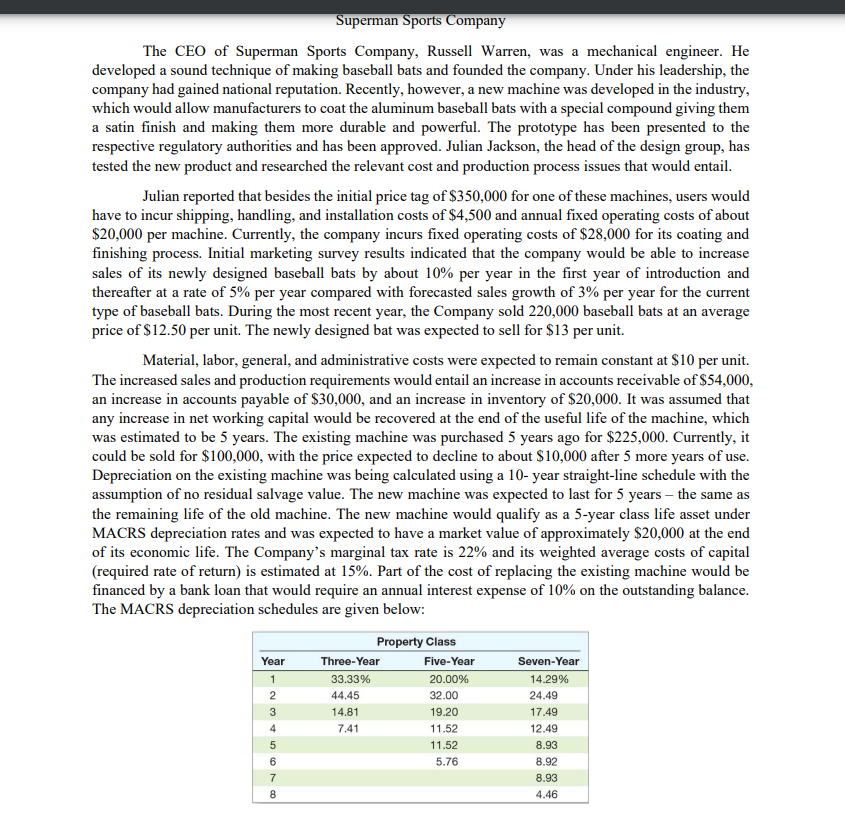

If someone could please break this question down for me that would be greatly appreciated. I have seen the same problem posted numerous times before, and previous answers have discussed things like "annual incremental revenues" and "annual incremental depreciation", but for my class, those items do not apply nor make sense for the problem. The answers that I am looking for are shown in the excel screenshots below. As you can see, we only need to find the OCF, NCS and change in NWC in order to find the answer we need, the CFFA. We do not need any other elements such as "incremental revenues" to be provided so please do not include those in the answer. We need the questions to be solved using the information in the google sheet; we need total income statements, for the new and for the old machine. These income statements only need to be proforma, meaning we only need sales, variablefixed costs, depreciation, EBIT, taxes, and net income. My main issue is with finding the discount rate in order to solve for the NPV and IRR, in addition to wondering if the years NCS and change in NWC should be left blank, or if answers need to be provided there. Therefore, if I could get some help solving specifically for the CFFA for each year, the discount rate, the npv the irr, the profitability index, and any blank spots on the google sheet, it would be greatly helpful.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock