Question: If someone please can help me answer this question please! :) Intro You collect data (Jan-2005 to Dec-2015) and regress monthly excess returns of an

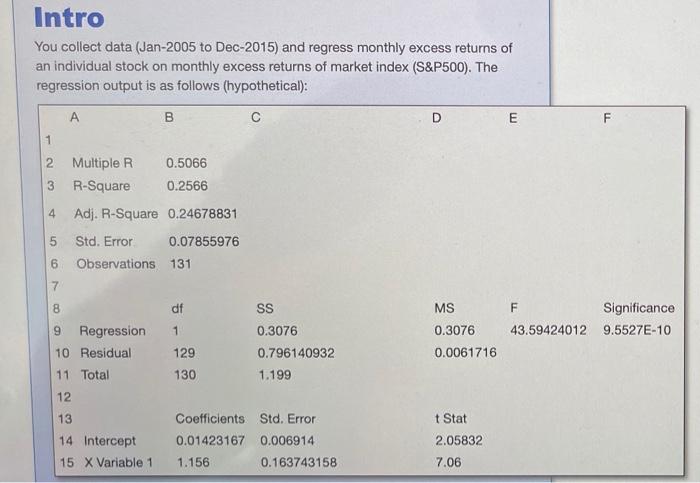

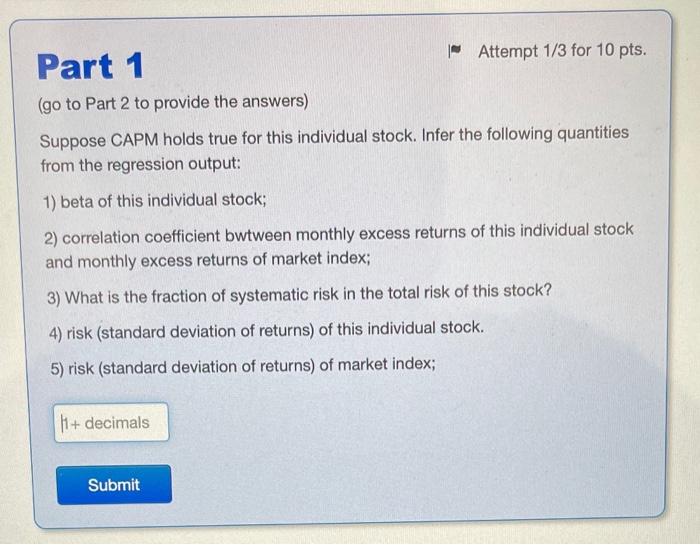

Intro You collect data (Jan-2005 to Dec-2015) and regress monthly excess returns of an individual stock on monthly excess returns of market index (S&P500). The regression output is as follows (hypothetical): B D E F 1 F 2 Multiple R 0.5066 3 R-Square 0.2566 4 Adj. R-Square 0.24678831 5 Std. Error 0.07855976 6 Observations 131 7 8 df SS 9 Regression 1 0.3076 10 Residual 129 0.796140932 11 Total 130 1.199 12 13 Coefficients Std. Error 14 Intercept 0.01423167 0.006914 15 X Variable 1 1.156 0.163743158 MS 0.3076 0.0061716 Significance 9.5527E-10 43.59424012 t Stat 2.05832 7.06 Part 1 Attempt 1/3 for 10 pts. (go to Part 2 to provide the answers) Suppose CAPM holds true for this individual stock. Infer the following quantities from the regression output: 1) beta of this individual stock; 2) correlation coefficient bwtween monthly excess returns of this individual stock and monthly excess returns of market index; 3) What is the fraction of systematic risk in the total risk of this stock? 4) risk (standard deviation of returns) of this individual stock. 5) risk (standard deviation of returns) of market index; 11+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts