Question: If something is No entry please put down no entry Chapman Company obtains 100 percent of Abernethy Company's stock on January 1,2020 . As of

If something is No entry please put down no entry

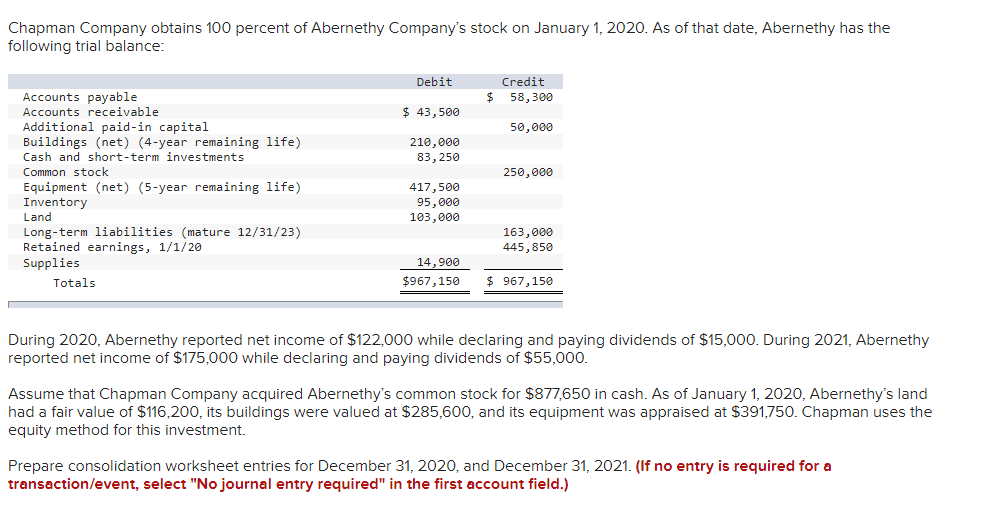

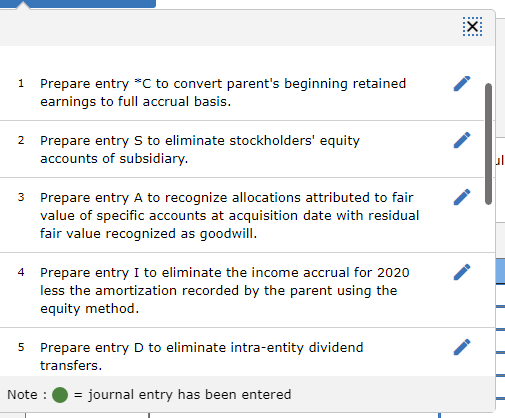

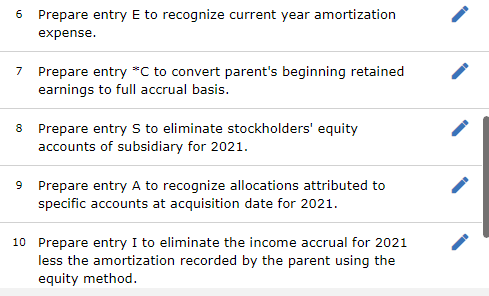

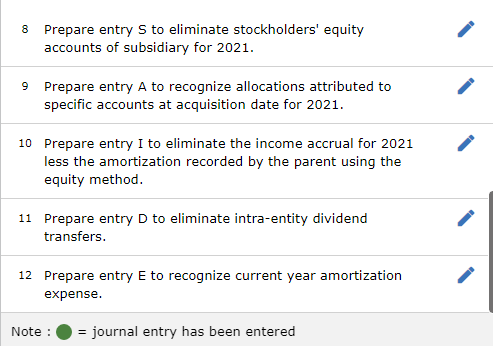

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1,2020 . As of that date, Abernethy has the following trial balance: During 2020, Abernethy reported net income of $122,000 while declaring and paying dividends of $15,000. During 2021, Abernethy reported net income of $175,000 while declaring and paying dividends of $55,000. Assume that Chapman Company acquired Abernethy's common stock for $877,650 in cash. As of January 1,2020 , Abernethy's land had a fair value of $116,200, its buildings were valued at $285,600, and its equipment was appraised at $391,750. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Prepare entry C to convert parent's beginning retained earnings to full accrual basis. 2 Prepare entry S to eliminate stockholders' equity accounts of subsidiary. 3 Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. 4 Prepare entry I to eliminate the income accrual for 2020 less the amortization recorded by the parent using the equity method. 5 Prepare entry D to eliminate intra-entity dividend transfers. 6 Prepare entry E to recognize current year amortization expense. 7 Prepare entry C to convert parent's beginning retained earnings to full accrual basis. 8 Prepare entry S to eliminate stockholders' equity accounts of subsidiary for 2021 . 9 Prepare entry A to recognize allocations attributed to specific accounts at acquisition date for 2021. 10 Prepare entry I to eliminate the income accrual for 2021 less the amortization recorded by the parent using the equity method. 8 Prepare entry S to eliminate stockholders' equity accounts of subsidiary for 2021 . 9 Prepare entry A to recognize allocations attributed to specific accounts at acquisition date for 2021 . 10 Prepare entry I to eliminate the income accrual for 2021 less the amortization recorded by the parent using the equity method. 11 Prepare entry D to eliminate intra-entity dividend transfers. 12 Prepare entry E to recognize current year amortization expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts