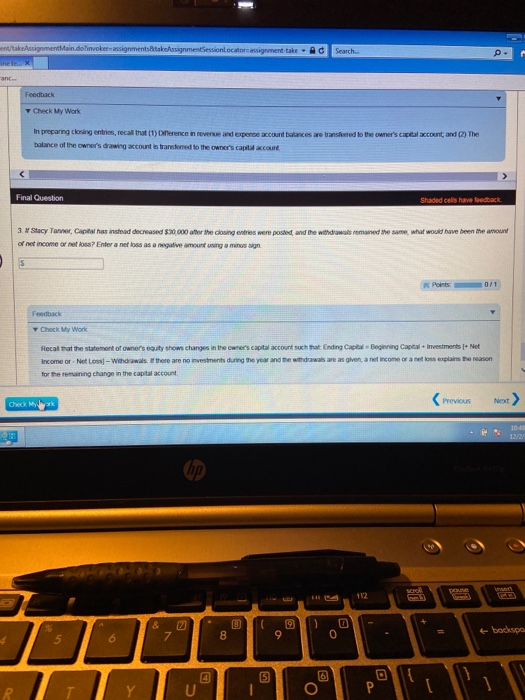

Question: if stacy tanner, has instead decrease $30000.00 after the closing entries were posted and the withdrawals remained the same, what would have been the amount

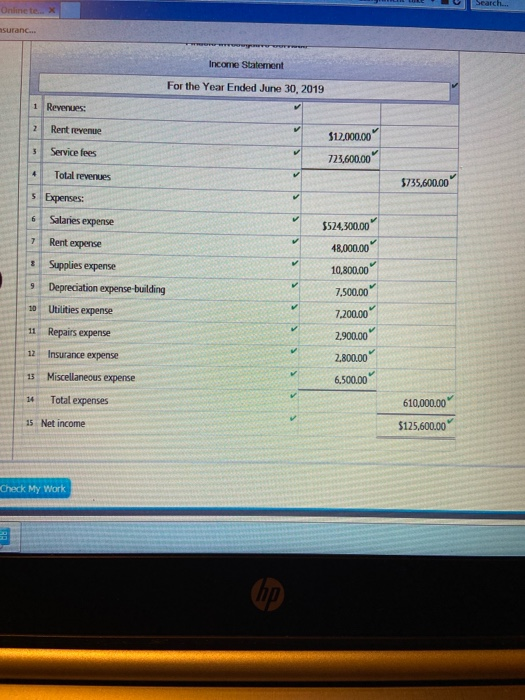

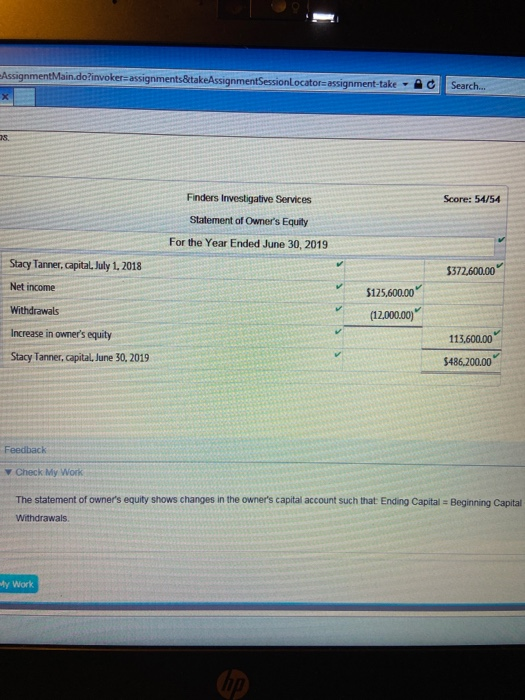

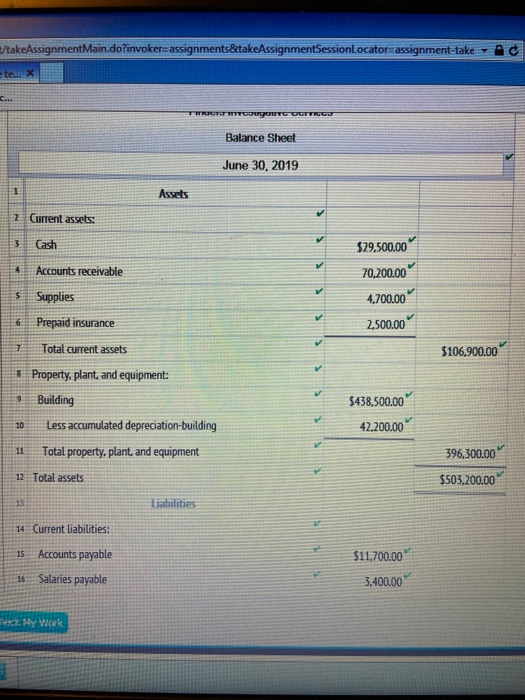

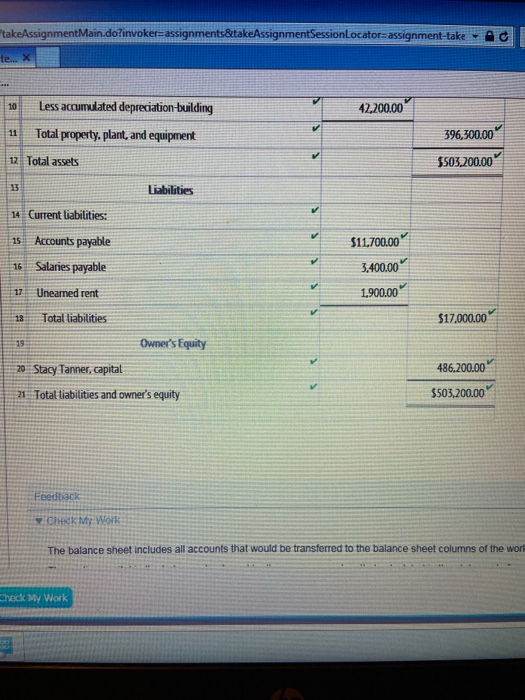

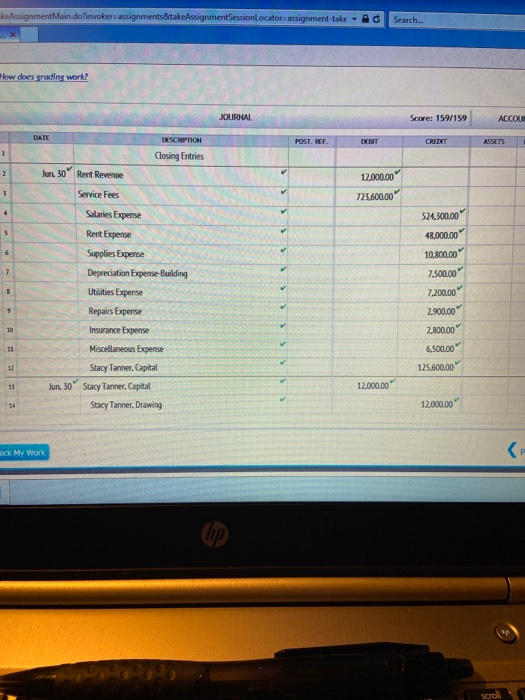

E U Search... Online te X nsuranc... Income Statement For the Year Ended June 30, 2019 Revenues: Rent revenue $12.000.00 Service fees 723,600.00 Total revenues $735,600.00 Expenses: Salaries expense Rent expense $524,300.00 48,000.00 10,800.00 7.500.00 Supplies expense Depreciation expense building 10 Utilities expense 7.200.00 11 Repairs expense 2.900.00 12 Insurance expense 2.800.00 13 Miscellaneous expense 6.500.00 14 Total expenses 610,000.00 $125,600.00 15 Net income Check My Work AssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator assignment-take A Search. Finders Investigative Services Score: 54/54 Statement of Owner's Equity For the Year Ended June 30, 2019 Stacy Tanner, capital, July 1, 2018 $372,600.00 Net income Withdrawals 5125,600.00 (12,000.00) Increase in owner's equity 113,600.00 5486.200.00 Stacy Tanner, capital, June 30, 2019 . Feedback Check My Work The statement of owner's equity shows changes in the owner's capital account such that Ending Capital Beginning Capital Withdrawals My Work /takeAssignment Main.do?invoker assignments&takeAssignmentSessionLocator assignment-take Balance Sheet June 30, 2019 Assets Current assets: Cash Accounts receivable $29,500.00 70,200.00 4.700.00 2,500.00 Supplies Prepaid insurance $106,900.00 Total current assets Property, plant, and equipment: 5 Building Less accumulated depreciation-building $438.500.00 42.200.00 Total property. plant and equipment 396,300.00 12 Total assets $503.200.00 Liabilities 14 Current Liabilities: 1 Accounts payable 15. Salaries payable $11.700.00 3.400.00 Hy work takeAssignmentMain.do?invokers assignments&takeAssignmentSessionLocator assignment-take AC 42,200.00 Less accumulated depreciation building Total property, plant, and equipment 396,300.00 $503.200.00 Total assets Liabilities 14 Current liabilities: Accounts payable $11.700.00 3.400.00 Salaries payable Uneamed rent 1.900.00 Total liabilities $17,000.00 Owner's Equity 20 Stacy Tanner, capital 486,200.00 21 Total liabilities and owner's equity $503,200.00 Feedback Check My Work The balance sheet includes all accounts that would be transferred to the balance sheet columns of the worl Check My Work kecignment Main dolinvokersassignments&takeAssignmentSession Locator assignment-take Ad Search How does grading work? JOURNAL Score: 159/159 ACCOU POST. REF. DENT CREDIT ASSETS Jun. 30 12,000.00 723,600.00 524.500.000 48,000.00 10,800.00 DESCRIPTION Closing Entries Rent Revenue Service Fees Salaries Expense Rent Expense Supplies Expense Depreciation Expense-Building Utilities Expense Repairs Expense Insurance Expense Miscellaneous Expense Stacy Tanner, Capital Stacy Tanner. Capital Stacy Tanner. Drawing 7.500.00 7.200,00 2.900.00 2,800.00 6.500.00 125.600.00 15 Jun 30 12.000.00 12.000.00 eck My Work CP ent/ a g mentMain.dolinvoerassignments takeAssignmentSessionlecators assignment take-AdSearch. Feedback Check My Work In preparing closing entries, recall that (1) Diference in d epende scount balances are transferred to the owner's capital account and balance of the owner's drawing account is transferred to the owner's capital account The Final Question Shaded cells have feedback remaned the same, what would have been the amount 3. Stacy Tarver, Capital has instead decreased 20 000 at the closing entries were posted and the widow Ofe income ornet ? Entranets as a negative amount ang aming Points Check My Work Recal trat the statement of owners guty shows changes in the owner's capital account such that Ending Capital Beginning Capital Investments - Net Income or- Neto - Withdrawals. If there are no investments during the year and the withdrawals are as given, an income orations explains the reason for the remaining change in the capital account Check Previous Next > backspo E U Search... Online te X nsuranc... Income Statement For the Year Ended June 30, 2019 Revenues: Rent revenue $12.000.00 Service fees 723,600.00 Total revenues $735,600.00 Expenses: Salaries expense Rent expense $524,300.00 48,000.00 10,800.00 7.500.00 Supplies expense Depreciation expense building 10 Utilities expense 7.200.00 11 Repairs expense 2.900.00 12 Insurance expense 2.800.00 13 Miscellaneous expense 6.500.00 14 Total expenses 610,000.00 $125,600.00 15 Net income Check My Work AssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator assignment-take A Search. Finders Investigative Services Score: 54/54 Statement of Owner's Equity For the Year Ended June 30, 2019 Stacy Tanner, capital, July 1, 2018 $372,600.00 Net income Withdrawals 5125,600.00 (12,000.00) Increase in owner's equity 113,600.00 5486.200.00 Stacy Tanner, capital, June 30, 2019 . Feedback Check My Work The statement of owner's equity shows changes in the owner's capital account such that Ending Capital Beginning Capital Withdrawals My Work /takeAssignment Main.do?invoker assignments&takeAssignmentSessionLocator assignment-take Balance Sheet June 30, 2019 Assets Current assets: Cash Accounts receivable $29,500.00 70,200.00 4.700.00 2,500.00 Supplies Prepaid insurance $106,900.00 Total current assets Property, plant, and equipment: 5 Building Less accumulated depreciation-building $438.500.00 42.200.00 Total property. plant and equipment 396,300.00 12 Total assets $503.200.00 Liabilities 14 Current Liabilities: 1 Accounts payable 15. Salaries payable $11.700.00 3.400.00 Hy work takeAssignmentMain.do?invokers assignments&takeAssignmentSessionLocator assignment-take AC 42,200.00 Less accumulated depreciation building Total property, plant, and equipment 396,300.00 $503.200.00 Total assets Liabilities 14 Current liabilities: Accounts payable $11.700.00 3.400.00 Salaries payable Uneamed rent 1.900.00 Total liabilities $17,000.00 Owner's Equity 20 Stacy Tanner, capital 486,200.00 21 Total liabilities and owner's equity $503,200.00 Feedback Check My Work The balance sheet includes all accounts that would be transferred to the balance sheet columns of the worl Check My Work kecignment Main dolinvokersassignments&takeAssignmentSession Locator assignment-take Ad Search How does grading work? JOURNAL Score: 159/159 ACCOU POST. REF. DENT CREDIT ASSETS Jun. 30 12,000.00 723,600.00 524.500.000 48,000.00 10,800.00 DESCRIPTION Closing Entries Rent Revenue Service Fees Salaries Expense Rent Expense Supplies Expense Depreciation Expense-Building Utilities Expense Repairs Expense Insurance Expense Miscellaneous Expense Stacy Tanner, Capital Stacy Tanner. Capital Stacy Tanner. Drawing 7.500.00 7.200,00 2.900.00 2,800.00 6.500.00 125.600.00 15 Jun 30 12.000.00 12.000.00 eck My Work CP ent/ a g mentMain.dolinvoerassignments takeAssignmentSessionlecators assignment take-AdSearch. Feedback Check My Work In preparing closing entries, recall that (1) Diference in d epende scount balances are transferred to the owner's capital account and balance of the owner's drawing account is transferred to the owner's capital account The Final Question Shaded cells have feedback remaned the same, what would have been the amount 3. Stacy Tarver, Capital has instead decreased 20 000 at the closing entries were posted and the widow Ofe income ornet ? Entranets as a negative amount ang aming Points Check My Work Recal trat the statement of owners guty shows changes in the owner's capital account such that Ending Capital Beginning Capital Investments - Net Income or- Neto - Withdrawals. If there are no investments during the year and the withdrawals are as given, an income orations explains the reason for the remaining change in the capital account Check Previous Next > backspo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts