Question: if the adjusting entries 1to 8 are not made. indicate the effect on net income, assets and liabilites ( overstatment, understatment or N/A)? i want

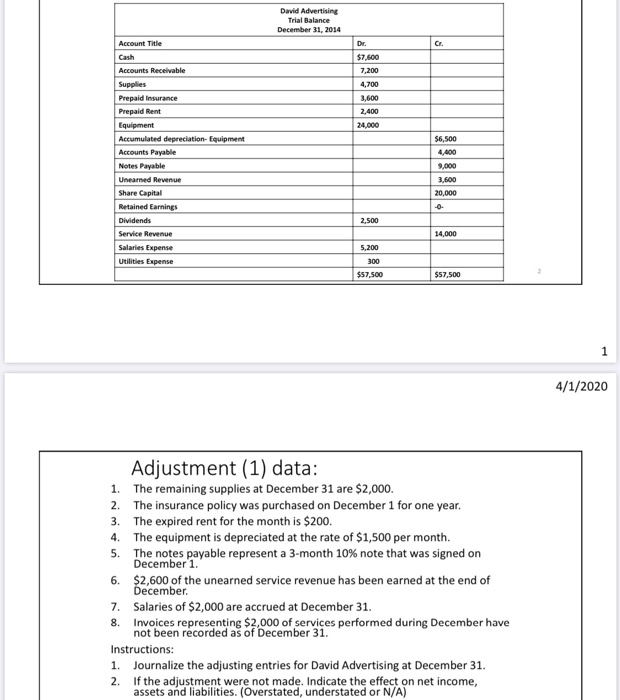

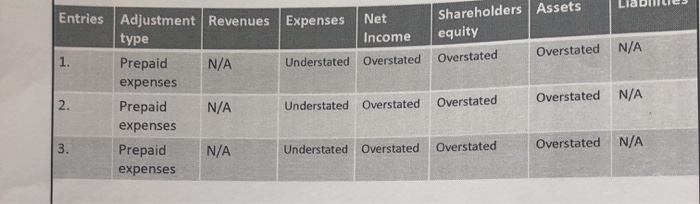

David Advertising Trial Balance December 31, 2014 Account Title $7.500 7,200 4,700 3.600 2,400 24,000 Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Equipment Accumulated depreciation Equipment Accounts Payable Notes Payable Unearned Revenue Share Capital Retained Earnings Dividends Service Revenue Salaries Expense Utilities Expense $6,500 4,400 9,000 3,600 20,000 2,500 14,000 5 .200 300 $57,500 $57,500 4/1/2020 Adjustment (1) data: 1. The remaining supplies at December 31 are $2,000. 2. The insurance policy was purchased on December 1 for one year. 3. The expired rent for the month is $200. 4. The equipment is depreciated at the rate of $1,500 per month. 5. The notes payable represent a 3-month 10% note that was signed on December 1. 6. $2,600 of the unearned service revenue has been earned at the end of December 7. Salaries of $2,000 are accrued at December 31. 8. Invoices representing $2,000 of services performed during December have not been recorded as of December 31. Instructions: 1. Journalize the adjusting entries for David Advertising at December 31. 2. If the adjustment were not made. Indicate the effect on net income, assets and liabilities. (Overstated, understated or N/A) Assets Liable Expenses Net Income Overstated Shareholders equity Overstated Overstated N/A Understated Entries Adjustment Revenues type Prepaid N/A expenses Prepaid N/A expenses Prepaid N/A expenses Overstated N/A Understated Overstated Overstated Understated Overstated Overstated N/A Overstated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts